The current week has begun quite calmly for the main world currency. The ISM report on the US manufacturing sector only caused a slight drawback. However, experts are confident in the stability of the US currency and the strengthening of its position.

The ISM report, demonstrating the state of the manufacturing sector of the US economy, presented a real picture of what was happening, which did not please the experts too much. Although the ISM index was higher than the September 2019 indicator, it did not reach the expectations of analysts, remaining close to a ten-year low. According to statistics, US production, like imports, fell to 2009 lows. According to experts, these indicators indicate a high probability of further easing of the Federal Reserve policy.

Many experts expected a stronger market reaction to the publication of a key US employment report. According to data presented last Friday, job growth slowed down a bit, but remained at an acceptable level (128 thousand instead of the forecasted 85–90 thousand), while the unemployment rate rose from 3.5% to 3.6%. Analysts also recorded an increase in average hourly wages of 0.2% instead of the expected 0.3%. Current data has confirmed a slowdown in the US economy, which is under severe pressure from prolonged trade wars. An additional confirmation of this fact was the fall in business activity in the manufacturing sector (ISM index) below the critical level of 50.

The US dollar did not avoid the negative impact. In the chain of "American economy - US currency", it is a key link that accounts for the main blows. The greenback is actively opposing them, but remains under pressure, which intensifies with optimism in the markets. Note that trade disputes have always spurred the growth of the greenback, so the weakening of trade tension will contribute to the demand for other assets to the detriment of the US dollar.

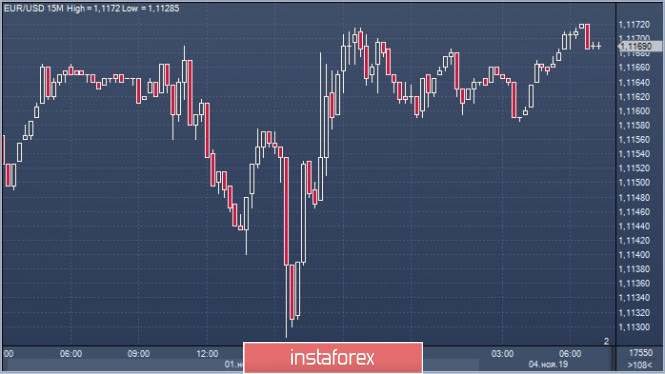

The U.S. administration is currently seeking to soften rhetoric, declaring optimism regarding negotiations between America and China. The White House is talking about a possible cancellation of tariffs for European cars. In such a situation, the EUR/USD pair may begin to sag. On the morning of Monday, November 4, it already showed a similar trend, trading near 1.1151–1.1152 marks.

The downward trend caused concern among market participants, as a day earlier the EUR/USD pair rose to 1.1169–1.1170, the highs of August 2019.

According to analysts, the pair is one step away from the key level of 1.1200. Overcoming this milestone, as in the case of the dollar index (DXY), is assessed by the market as a prerequisite for further growth. If this level is overcome, the EUR/USD pair will occupy high positions and maintain them until the end of 2019, experts said. The implementation of such a scenario will raise the pair almost to an unattainable height - up to 1.1400 and above.

On Monday, before starting to rise, the EUR/USD pair fell to 1.1157–1.1158. Now the pair has slightly increased to 1,1159–1,1160.

Experts rate high chances that the pair will continue the rally. To implement this scenario, a relatively calm external background is needed, that is, the absence of a hard Brexit, an escalation of the conflict between the US and the EU, as well as the stabilization of Washington-Beijing relations. In this case, the EUR/USD pair, having overcome the key barrier of 1,1200, may begin to move to 1.1260–1.1270. For this, the "bulls" will need to break through the resistance at the levels of 1.1175–1.1190. As for the current sentiment, analysts are confident that market players will seek to close long positions in the dollar.

Long-term observations show that the US currency can withstand even the most unfavorable factors. Apart from market volatility and an unstable external background, these include mixed economic data on the US economy and the Fed's attempts to weaken the national currency. Nevertheless, the greenback can cope with the situation. Its strength allows it not to sag under the pressure of negative circumstances, experts conclude.

At the time, the EUR / USD pair reached the level of 1.1165–1.1166, trying to exceed what was achieved.

The material has been provided by InstaForex Company - www.instaforex.com