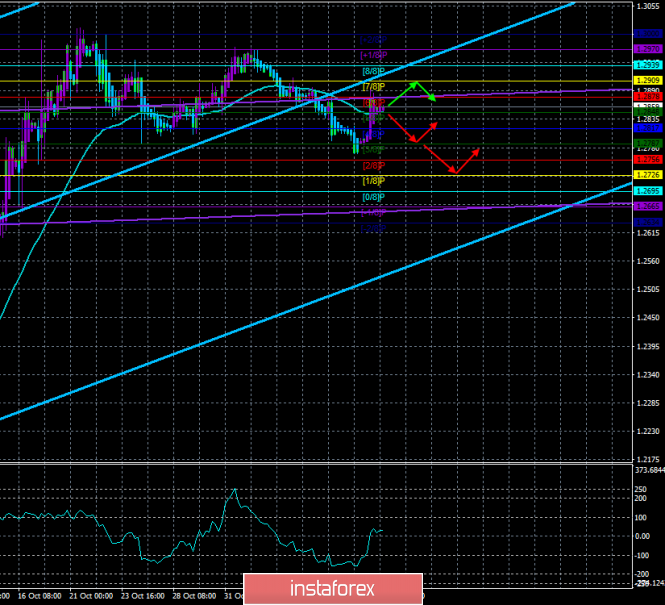

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – upward.

The lower channel of linear regression: direction – upward.

The moving average (20; smoothed) – sideways.

CCI: 32.5643

The British pound, which yesterday unexpectedly rose by 80 points, just as unexpectedly as 800 a few weeks ago, seems to end its climb. Recall that the information, which this time pushed the pound up, stated that the leader of the Brexit party, Nigel Farage, would not run for election in the constituencies won by the Conservatives in 2017. That is, Farage almost openly declared that he is in the same boat with the conservatives in the upcoming elections, and the goal of his party is to wean as many votes from competitors as possible.

How honest this is with the electorate is the question. That is, it turns out that the British political forces, to achieve their goals, will not be allowed in some districts (and there are only 317 of them) to vote, for example, for Brexit party deputies. Like this? It is clear that Farage and Boris Johnson have decided to join forces to implement Brexit, and for this to happen, a convincing victory is needed in the election, but, from our point of view, this is beyond "fair play". However, for Boris Johnson, such actions are not new. We recall only the topic with the prophecy of the work of Parliament, with which Johnson simply wanted to remove the deputies so that they could not block the "hard" Brexit. Well, somewhere in Washington, US President Donald Trump rejoices, who is sleeping and seeing how Great Britain will leave the EU, preferably without any agreements. Trump's idea worked, the Brexit and Conservative parties joined forces. Now we need to win on December 12. And then – the most interesting. Donald Trump is in favor of a speedy Brexit, but against making any "deals". It is the same option that Nigel Farage holds. But Boris Johnson, who initially had the same rhetoric, has now changed it to "Brexit with a deal," as Parliament refused to approve the option of leaving without an agreement, and Johnson's "move of the horse" with prorogation failed. However, if the conservatives win the election with the necessary advantage, will Boris Johnson return to the idea of implementing a "hard" Brexit? If the votes in parliament are enough to support any Brexit scenario, will the Prime Minister return to the idea of an unordered divorce, given that his name is often associated with the name of Donald Trump, who opposes any agreements with Brussels and promises a "grand" trade deal if there are no agreements with the European Union? We believe that this is a very serious issue, because you can expect anything from Johnson, and the people of the UK need to take the issue of voting very seriously, because without too much pathos we can say that the upcoming elections will indeed be one of the most important in recent decades for the United Kingdom. Of course, Boris Johnson's return to the idea of a "hard" Brexit is just a hypothesis now.

The pound, from our point of view, reacted once again not quite logically. We do not believe that the growing chances of a conservative victory are positive news for the pound. At least as long as the party is led by Boris Johnson, who, if he had his way, would have left the EU long ago, without wasting time negotiating an agreement. Thus, we believe that with the growing chances of the conservatives winning the election, the chances of some sort of "surprise" from Boris Johnson are also growing. And this "surprise" is unlikely to please the British currency. From a technical point of view, the pound/dollar pair is now fixed above the moving average line, so the trend has changed to an upward one. However, we believe that today or tomorrow, the pair will return to the area below the moving average. Today, for example, traders may be disappointed by another package of weak macroeconomic information from the UK.

Nearest support levels:

S1 – 1.2848

S2 – 1.2817

S3 – 1.2787

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2909

R3 – 1.2939

Trading recommendations:

The GBP/USD pair has consolidated above the moving average, while volatility remains low. Formally, traders can now consider buying the pound with targets of 1.2878, 1.2909, and 1.2939. However, we still recommend trading small volumes. The downward movement of the pair in the coming days remains preferable, however, now the bears need to wait for the pair to re-consolidate below the moving average line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression – the blue lines of the unidirectional movement.

The lower channel of linear regression – the purple line of the unidirectional movement.

CCI – the blue line in the regression window of the indicator.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com