The single European currency reacted rather violently to preliminary data on business activity indices both in Europe and the United States. Moreover, they showed completely different results than expected. Thus, the index of business activity in the services sector in Europe did not increase from 52.2 to 52.5, but instead fell to 51.5. Largely because of this, the composite index of business activity decreased from 50.6 to 50.3, although it was predicted to grow to 50.9. The index of business activity in the manufacturing sector at least somehow pleased, as it grew from 45.9 to 46.6. Indeed, it should be noted that they were already waiting for its growth, but only to 46.4. So it is not surprising that against this background, the single European currency immediately began to lose its position.

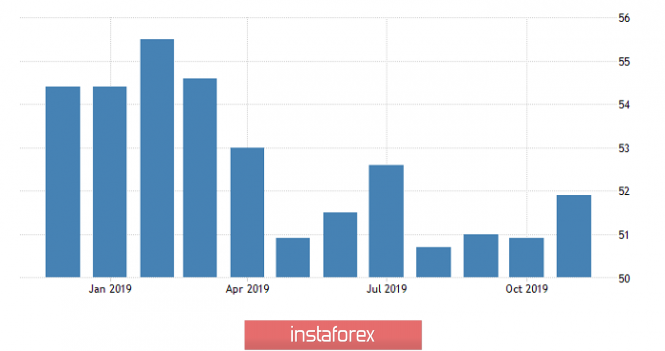

But the difficulties for the single European currency did not end there, since preliminary data on business activity indices of the United States, unlike Europe, turned out to be better than forecasts. In particular, the index of business activity in the services sector grew from 50.6 to 51.6, while they expected growth to 51.0. The index of business activity in the manufacturing sector grew from 51.3 not to 51.5, but already to 52.2. The result of all this was an increase in the composite business activity index from 50.9 to 51.9. As a result, we once again observe how statistics show us the worsening situation in Europe and the improvement in the United States.

Composite Business Activity Index (United States):

In general, investors have already fully completed preliminary data on business activity indices, so the market needs new ideas. Which today is simply not there. At least some IFO data for Germany may be of interest. In particular, the index of economic expectations should grow from 91.5 to 92.5. Business optimism index from 94.6 to 95.0. Well, an indicator of the current situation, from 97.8 to 98.0. The only trouble is that these indicators do not affect the market in any way, and not only because the majority of market participants do not understand what they mean, but also for the simple reason that they concern only Germany and not Europe as a whole. Thus, in the absence of any ideas and guidelines, the market will hang around current values.

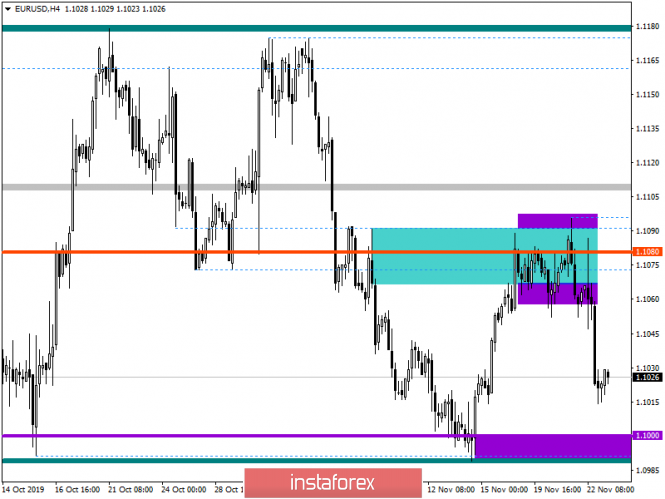

In terms of technical analysis, the EUR/USD currency pair nevertheless managed to show the proper fluctuation and also overcame one of the control points of 1.1055/1.1100, which led to an impulsive movement and as a fact the resumption of the recovery process. What we had was a variable flat of 1.1055/1.1080 at the correction stage, which nevertheless fell, and we saw a characteristic acceleration towards the recovery process. In turn, the control point in the face of the psychological level of 1.1000 has not been reached, thus there is still support, where stagnation/pullback occurred near it.

It is likely to assume that the psychological level of 1.1000 will try to keep the quotation, as it was on record, having a kind of amplitude within it as a result. Thus, to begin with, it is worth considering a control convergence with a fluctuation of 25/30 points, which will already be a good sign, then we analyze the price consolidation points. An alternative scenario will not allow the quote to come close to the level of 1.1000 and stagnation with a return point will already form relative to the current coordinates.

We concretize all of the above into trading signals:

- We consider long positions in case of price consolidation higher than 1.1035, not a puncture shadow.

- We consider short positions at 1.1015, with the prospect of a move to 1.1000. The further course is considered after the breakout of the psychological level and price consolidation lower than 1.0990.

From the point of view of a comprehensive indicator analysis, we see that the main range of technical tools on hourly and daily intervals signal a downward interest. Minute intervals work at a variable pivot point and stagnation, providing a versatile signal.