The euro-dollar pair ended the previous trading week with significant losses, although it remained within the price range of 1.0980-1.1090. Traders closed at around 1.1021 last Friday, and today began a new week at the same level. The immediate reason for reducing the pair was the disappointing data on the growth of PMI indices in Europe. The manufacturing sector and the service sector again show a slowdown, and this fact indicates a deceleration in the eurozone economy as a whole.

Only the index of business activity in the manufacturing sector in Germany turned out to be in the green zone: instead of the projected decline, it slightly increased (growth has been fixed for the second consecutive month) and is at around 43.8 points. But, firstly, this index still remains below the key 50-point level (which indicates a decrease in production), and secondly, all other PMI indices, both in Germany and in other key European countries, came out worse than expected. Therefore, the likelihood of further easing of the ECB's monetary policy remains high, despite the current split in the regulator's camp and Lagarde's calls for the use of fiscal policy.

Quite important macroeconomic statistics will also be published this week, which will affect the dynamics of the EUR/USD pair. For example, today we find out data on the growth of the German indicator of the business environment from the IFO agency. Following the disappointing data from PMI and rather optimistic figures from ZEW - it is very interesting as to which side IFO specialists will take. According to preliminary forecasts, the indicator of business environment conditions and the indicator of economic expectations will demonstrate positive dynamics. Otherwise, the euro will be under additional pressure.

Federal Reserve Chairman Jerome Powell is set to speak on Tuesday. He will deliver a speech at the Providence Economic Forum in Rhode Island. As you know, Powell recently met with the US president at the White House. This meeting was quite spontaneous in nature - and this fact alerted many experts. In their opinion, Trump discussed with Powell the prospects for the Fed's monetary policy in the event of another failure in the negotiation process with China. As the head of the White House himself admitted, he raised many topics at the meeting, including the topic of negative rates. The US regulator immediately responded to the president's statement, refuting it in his comment. According to the official position of the Fed, Powell did not discuss the prospects of monetary policy with the country's leader, since such issues are decided by the members of the Fed collectively, based on the current state of affairs. Powell will be able to comment on the current situation himself on Tuesday - although given his caution, he can ignore this topic without going beyond the scope of the forum topics. An indicator of US consumer confidence will also be published on Tuesday. After a slight decline in October, it should slightly recover up to 127 points this November. Data on the volume of home sales in the US primary market will also be released today, which is also projected to show positive dynamics.

You should pay attention to the final assessment of US GDP growth for the third quarter that is set to be released on Wednesday. According to forecasts, this indicator will not be revised, but instead it could cause increased volatility for the pair. I recall that according to preliminary estimates, the US economy slowed down to 1.9%, while the price index of GDP fell to 1.7%. Also on Wednesday, EUR/USD traders will be interested in the main index of personal consumption expenditures, which measures the core level of expenditures and indirectly affects the dynamics of inflation in the United States. It is believed that central bank members carefully monitor this indicator. According to forecasts, the index will demonstrate contradictory dynamics - it will grow to 0.2% in monthly terms and decrease to 1.6% in annual terms. This release may have an impact on the dynamics of the pair only with strong fluctuations, when the real numbers differ significantly from the forecast values.

US trading floors will be closed on Thursday for the celebration of Thanksgiving in the United States. Therefore, EUR/USD price fluctuations on this day are expected during the European session, when data on the growth of German inflation will be published. It is expected that the consumer price index in Germany will show a negative trend - in monthly terms it will return to the negative area (-0.7%), and in annual terms it will drop to 1%. This release will be the "main rehearsal" before the publication of the pan-European inflation indicator.

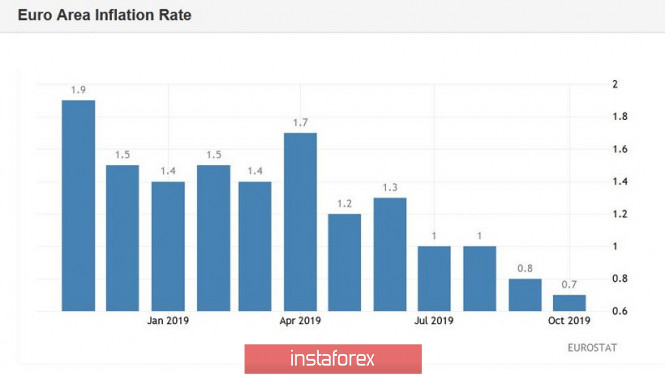

We will learn the dynamics of European inflation on Friday. The general consumer price index has been gradually decreasing since June, and in October reached 0.7%. In November, a slight recovery is expected - according to analysts, the figure will rise to the level of 0.8%. Core inflation should also slightly grow - according to experts, the core index will be released in the green zone, at around 1.2%. On the same day, data will be published on the growth of the labor market in the eurozone in October. Positive dynamics is also expected here: the indicator may drop to a record low level of 7.4%.

In addition to macroeconomic statistics,EUR/USD traders will sharply react to the external fundamental background. Trump is expected to sign the Hong Kong Human Rights and Democracy Act in the near future in support of Hong Kong protesters. This step will cause a confrontation with Beijing, amid ongoing trade negotiations. If the prospects of signing the first phase of the US-China agreement are again threatened, the EUR/USD pair will be under strong pressure: this fact may pull down the price under the key support level of 1.0980. On Friday, on the other hand, Trump said in an interview with Fox News that the trade deal with China is "potentially very close." If the external fundamental background improves, the pair may again approach the boundary of the 11th figure - especially if macroeconomic statistics are on the side of the single currency.

The material has been provided by InstaForex Company - www.instaforex.com