The pressure on risky assets continued after a small attempt to grow amid a decision by US President Donald Trump to postpone consideration of the introduction of duties on imports of European cars. Good indicators on the growth rate of inflation in the United States supported the dollar. However, the defining pressure on the euro was made by talk that negotiations between the US and China stalled again. This happened due to the issue of purchases of agricultural products.

The American leader has repeatedly noted that China should purchase agricultural products on a larger scale, which is one of the conditions of the trade agreement. Yesterday, from certain sources, there is information about the fact that Beijing has refused to make a promise with regards to specific purchases of US agricultural products. Most likely, several statements on this issue will be made today by the White House administration, which will put additional pressure on the European currency, which still needs to "survive" several important fundamental statistics.

In the first half of the day, a report on German GDP will be released, and it is expected to indicate a contraction of the country's economy in the 3rd quarter of this year, which will further lead to a recession. The uncertainty of trade relations and weak economic activity negatively affects the prospects of the German economy. German GDP is expected to decline in the 3rd quarter by 0.1% compared with the previous quarter.

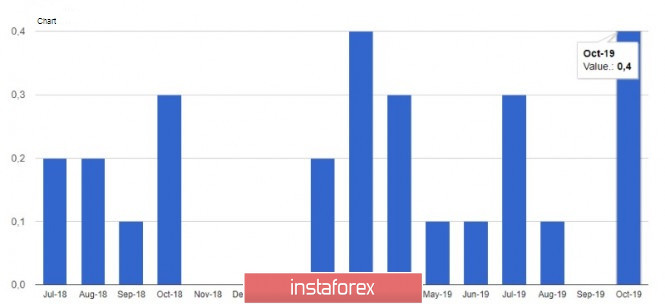

As noted above, good data on inflation in the US supported the US dollar, but the slowdown in wage growth will harm Americans' spending. According to the US Department of Labor, the consumer price index (CPI) in October this year rose by 0.4% compared to the previous month, while economists had predicted its growth of 0.3%. As for core inflation, which does not take into account food and energy prices, there was an increase of 0.2% in October compared to September, which fully coincided with the forecasts of economists. The increase was mainly due to energy prices, which in October 2019 increased by 2.7% compared to the previous month. Compared with the same period the previous year, the index rose by 1.8% in October after rising by 1.7% in September.

A report by the US Department of Labor also indicated a reduction in earnings in October this year, even though unemployment is at its lows. The reduction in wages will negatively affect consumer spending, which will provide weaker support for the economy.

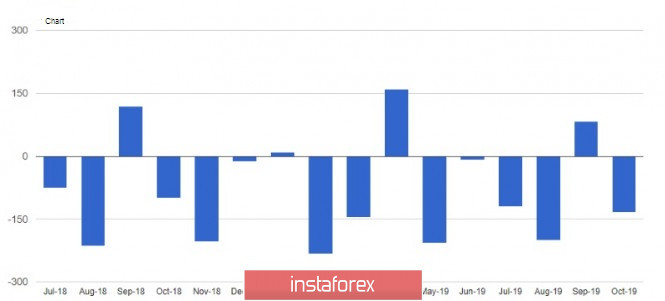

The US budget deficit continued to grow. According to the US Treasury Department, the deficit increased to 134 billion US dollars, and this was because expenses exceeded revenues. The annual deficit exceeded $1 trillion. In total, government spending in October amounted to 380 billion dollars, which is 8% higher than a year ago. But revenues were at $246 billion, decreasing by 3% compared to last year. On an annualized basis, revenues totaled $ 3.4 trillion and expenses were $ 4.4 trillion. The total deficit amounted to 4.8% of GDP.

Yesterday's speech by the head of the Federal Reserve System to the Joint Economic Committee did not make significant changes to the market since on the whole, it did not differ much in originality.

Jerome Powell said interest rates would remain unchanged unless the outlook changed significantly and monetary policy was determined in advance. Hinting at a possible rate cut, Powell noted that the Fed will act accordingly in case of changes in prospects due to some events. The head of the committee expects moderate economic growth, a strong labor market, and inflation near the target level of 2%. Powell also paid special attention to low-interest rates, which, in his opinion, may limit the ability of monetary policy in terms of maintaining the economy.

Let me remind you that yesterday, US President Donald Trump once again criticized the actions of the central bank, saying that the United States needs low-interest rates in a fairly long period.

As for the technical picture of the EURUSD pair, it has not changed much compared to yesterday's forecast. Bears are waiting for the update of the lows in the area of 1.0990 and 1.0960, which will increase the pressure on risky assets and maintain the current downward trend, which has been observed since November 4 this year. Much will depend on today's data on the GDP of Germany and the eurozone, as well as producer prices in the USA. Weak eurozone reports will put pressure on the trading instrument, however, if the bulls manage to regain the resistance of 1.1030, the situation could change dramatically, which will lead to an upward correction of risky assets in the areas of 1.1055 and 1.1090.

The material has been provided by InstaForex Company - www.instaforex.com