The same day has come that is designed to dispel the boredom of the last days. All the attention of investors today has shifted to the meeting of the Board of the European Central Bank on monetary policy. Although it is not the meeting itself that matters, but the subsequent press conference of the head of the European Central Bank. Moreover, this is a farewell meeting for Mario Draghi, after which he transfers his power to Christine Lagarde. It is quite obvious that according to the results of today's meeting, the monetary policy of the European Central Bank will not undergo any changes. However, Mario Draghi's farewell speech is of great interest, and even concern. It is clear that after they have reduced the deposit rate, the next step should be to lower the refinancing rate. But the question is, it is completely incomprehensible when exactly this will happen. So, if in his farewell, Mario Draghi expresses concern about the state and dynamics of the European economy, there will be no doubt that Christine Lagarde will lower the refinancing rate to negative values, right before Christmas. and no need to say how it will affect the single European currency. However, if Mario Draghi manages to make a long and lengthy speech, completely devoid of any practical meaning, then the single European currency can still hold its ground. Perhaps even slightly raise it.

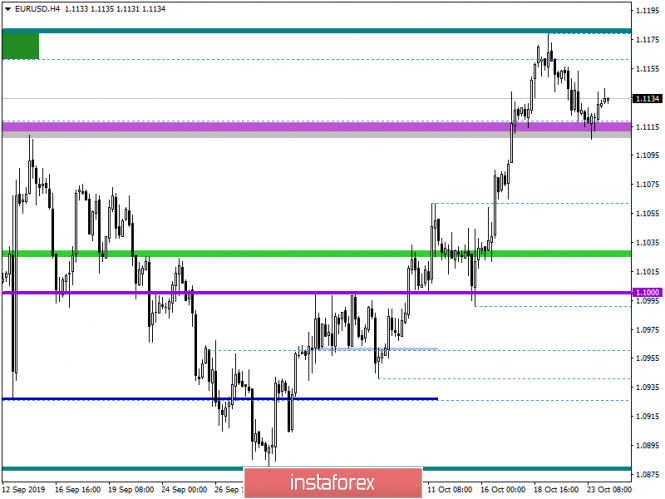

The EUR/USD pair colorfully fulfilling the mirror resistance level of 1.1180 went to the area of 1.1100, where a level that was quite important for the market had previously passed. The subsequent fluctuation in the form of a local rebound was expressed more on the general ambiguity than on the background of working off the level of 1.1100, since the general market overbought is still preserved on the market. In terms of a general review of the trading chart, we see an attempt to restore the main course, relatively elongated correction, but so far to no avail. In turn, the almost vertical movement continues to focus on the peaks of the oblong correction, and the emotional component of market participants plays an integral role here.

It is likely to assume that the initial fluctuation with respect to the values of 1.1105/1.1145 may remain for some time, where it is worth analyzing not only boundaries, but also the information background for harsh statements by the head of the ECB. In the event of a peaceful background of information, the horizontal oscillation may be delayed, with a slight shift of the existing boundaries.

Concretizing all of the above into trading signals:

- Long positions, we consider in case of a clear consolidation of the price higher than 1.1145.

- Short positions, we consider in case of a clear consolidation of the price lower than 1.1105-1.1100.

From the point of view of a comprehensive indicator analysis, we see that the minute and hour periods are still in the recovery phase, signaling sales, where the indicators can rightfully change due to accumulation. Daily periods remain committed to the inertia, signaling purchases.