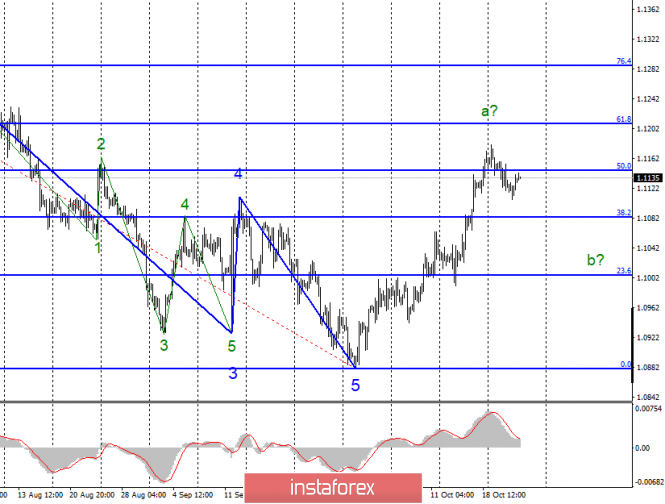

EUR / USD

Wednesday, October 23, ended for the EUR / USD pair with an increase of only a few basis points. However, this is clearly not enough to consider the completion of the correction wave b. Most likely, this wave will take a clearly expressed 3-waveform. Thus, another impulse down can be expected. At the same time, a successful attempt to break through the 50.0% Fibonacci level will show the willingness of the currency market to buy the instrument. In addition, the news background of today can even make adjustments to the entire wave markup of the euro-dollar instrument.

Fundamental component:

The news background for the EUR / USD pair remained absent for the last 4 days. However, everything will change today, since the index of business activity in the services and production sectors will be released in the European Union. The same indices will also be released after lunch in America. In addition, the change in the volume of orders for durable goods in America and the results of the meeting of the European Central Bank will become known. The "cherry on the cake" will be the speech by Mario Draghi, who will leave the post of ECB chairman on October 31 after 8 years of rule. Thus, one can expect anything from his speech. Perhaps, this will be a "farewell" speech, and Draghi will possibly remain a professional until the end and will cover only moments related to the EU economy, monetary policy and prospects. In any case, Thursday promises to be very interesting.

Purchase goals:

1.1208 - 61.8% Fibonacci

1.1286 - 76.4% Fibonacci

Sales goals:

1.0879 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves and supposedly completed the construction of wave a, despite a successful attempt to break through the 50.0% Fibonacci level. On the other hand, breaking through the level of 50.0% in the opposite direction indicated the readiness of the instrument to build wave b, which in theory, should turn out to be more extended than now. Thus, I recommend buying the instrument after the completion of the wave b.

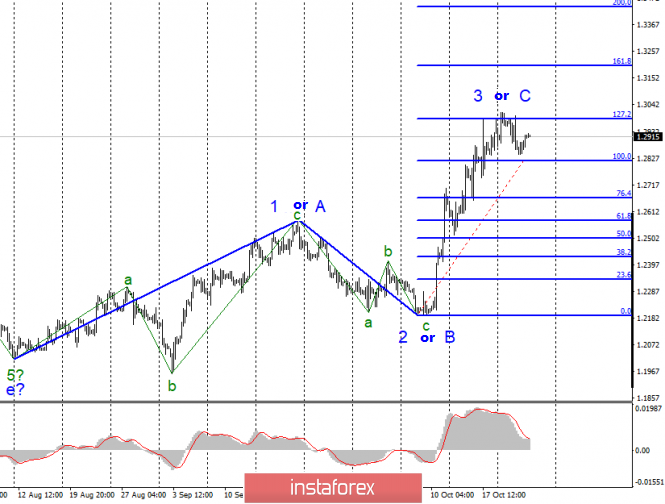

GBP / USD

On October 23, the GBP / USD pair gained about 50 basis points. However, the estimated wave 3 or C is still determined to be completed now. If this is true, then the decline in the quotes of the pound-dollar instrument will resume with targets located at around 27th figure, at least. A successful attempt to break through the 127.2% Fibonacci level will indicate that the markets are now ready for new purchases of the pound sterling, but this, as in the case of the euro, can be prevented by the news background.

Fundamental component:

All the favorability and positivity of the news background for the British pound now only lies in the fact that the tough Brexit is moving away from the near future. Due to this, the British currency has no more special reasons to increase. The current growth of the instrument is very similar to speculative, after which an equally strong decline will follow. Brexit can be said to have already been ported. EU leaders, in turn, have approved the postponement of Brexit, despite Boris Johnson's convincing arguments about the inappropriateness of such actions and their negative reflection on the EU and Britain. Nevertheless, the issue still rests on the approval of the transaction by the British Parliament, which we may not see in principle. If this option is not destined to come true, then early re-election to the Parliament may be held, Labor will try to hold a second referendum, and Boris Johnson himself may be cast a vote of no confidence. The range of possible scenarios is huge and most of which is not positive for the UK currency.

Sales goals:

1.2191 - 0.0% Fibonacci

Purchase goals:

1.2986 - 127.2% Fibonacci

1.3202 - 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. An unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a completion of the alleged wave 3 or C and become the basis for new purchases of the instrument.

The material has been provided by InstaForex Company - www.instaforex.com