4-hour timeframe

Amplitude of the last 5 days (high-low): 49p - 107p - 93p - 264p - 298p.

Average volatility over the past 5 days: 162p (high).

If you do not know the fact that Queen Elizabeth II of Great Britain is very far from politics, as well as from the real approval or rejection of any political decisions of her government, then you might think that the fate of Brexit has already been decided. After all, the Queen of Great Britain herself at her 65th throne speech at the opening of the next session of the Parliament said that the priority is to leave the EU on October 31. However, during Boris Johnson's reign of the UK, traders have already figured out many political nuances and now many people already know that the Queen usually fulfills all the requests of her prime minister. It was at the request of the prime minister that the Queen approved the prorogation of the work of Parliament, which was later declared illegal by the Supreme Court. Thus, the fact that Queen Elizabeth II declared the priority of leaving the EU on October 31, in fact, does not mean anything. In addition, Elizabeth II noted that her government wants to build a new system of relations with the European Union, built on the principles of mutually beneficial cooperation and free trade. No new information regarding Brexit was received on Monday, October 14th. And this is alarming. Either the parties are working tirelessly on drafting a new deal and they do not have time to distribute interviews, or negotiations are no longer being conducted (or are being conducted for show), as the parties understand that in 4 days they will come to an agreement to which they could not reach in a few years, unrealistic. One way or another, but the EU summit will still be held on October 17-18, and in theory we are waiting for Boris Johnson to ask Brussels for another postponement. It is difficult to say how such a step would affect his political career. We have repeatedly listed all the defeats of Johnson as prime minister, but the list of his victories is short. Now, if Johnson asks to postpone Brexit, it will mean that his words "it is better to die in a ditch than to ask for a Brexit delay" were just words, and the prime minister does not value his own word too much. We also recall that in addition to colorful and artistic phrases and epithets, the prime minister has repeatedly stated that he will not ask the European Union to postpone Brexit.

In the meantime, the pound began to adjust against a two-day rally up, during which it managed to rise by almost 5 cents. From our point of view, this growth was completely unjustified, but it already has a place to be, so now we are waiting for a downward correction to the Kijun-sen line, but we assume that under certain circumstances the pound may even continue to grow. These circumstances are very simple: the deal with the European Union until October 19, Parliament gives the go-ahead on October 19 and the UK leaves the EU according to a "soft" scenario on October 31. What is the probability of the execution of this option, you decide, dear traders.

By the way, tomorrow, in the UK, quite important macroeconomic data on the average wage for August, as well as on the unemployment rate, will be published. However, we believe that traders will ignore these reports, as they are now completely and completely absorbed in the Brexit theme.

Trading recommendations:

The GBP/USD currency pair has started a downward correction. Thus, we recommend now to wait until the correction is completed in order to be able to resume trading on the rise, however, we warn that this week high pound/dollar volatility is possible, as well as sharp and frequent reversals.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

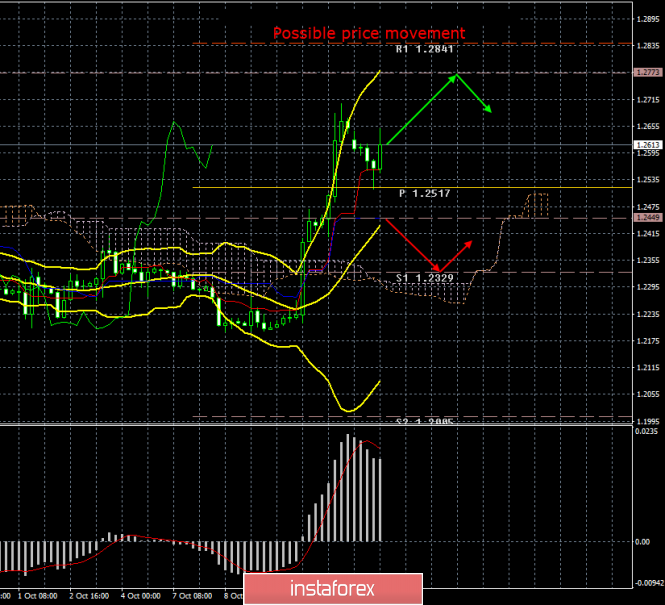

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com