To open long positions on EURUSD you need:

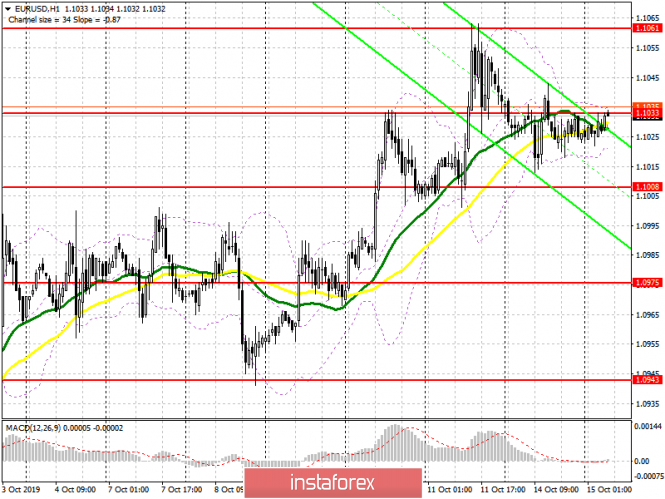

Market volatility was very low yesterday due to Columbus Day. Therefore, no changes have occurred from a technical point of view. Today, the calculation will be on the data on the index of moods in the business environment of Germany and the eurozone from the ZEW Institute. In case of weak reports, it is best to open long positions in EUR/USD after a downward correction to support at 1.1008, or immediately to rebound from a larger low of 1.0975. However, the main task of the bulls will be to return to the resistance of 1.1035, above which the pair will try to update last week's highs in the area of 1.1061, where I recommend profit taking.

To open short positions on EURUSD you need:

The main objective of the bears will be the return of EUR/USD to the support of 1.1008, and the breakdown of this level will put new pressure on the euro, which will push the pair to a low of 1.0975, where I recommend profit taking. However, everything will depend on fundamental data for Germany and the eurozone. Failure to consolidate above the resistance level of 1.1035, as it was yesterday in the morning after the release of reports, will also be a kind of signal to sell EUR/USD. Short positions can be opened immediately on the rebound from a high of 1.1061, however, the direction in the pair will depend on further negotiations between the United States and China.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger bands

Volatility is very low, which does not provide signals on entering the market.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20