To open long positions on EURUSD you need:

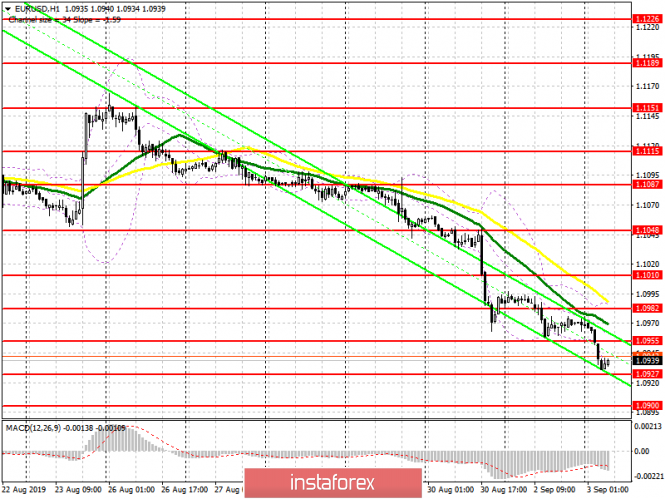

Yesterday's weak reports on manufacturing activity in the eurozone once again proved the fact that the European economy is seriously suffering from trade conflicts and continues to slow down. Currently, euro buyers are required to maintain the support level of 1.0927, and only the formation of a false breakdown there will be the first signal to open long positions. However, such a scenario is permissible only when good data on the eurozone producer price index are released. If the pressure on EUR/USD persists further, it is best to count on new long positions after updating lows near 1.0900 and 1.0873. The main task of the bulls will be to return to the resistance of 1.0955, from where a larger upward correction will lead to a high of 1.0982, where I recommend taking profits.

To open short positions on EURUSD you need:

Bears will continue to rely on weak reports on the eurozone, and a repeated support test of 1.0927 will lead to a new wave of sales of the euro with updating lows in the areas of 1.0900 and 1.0873, where I recommend taking profits. However, the focus will be shifted in the afternoon, when reports on manufacturing activity in the US come out. Only with good performance can we expect further movement of the euro down. In the upward correction scenario, I recommend counting on short positions in EUR/USD only after a false breakdown in the resistance area of 1.0955, however, the best option for sales is to update the high of 1.10982.

Signals of indicators:

Moving averages

Trading below 30 and 50 moving averages, indicating a continued decline in the euro.

Bollinger bands

If the euro rises in the morning, short positions can be opened by a rebound from the upper boundary of the indicator in the region of 1.0982. A break of the lower border in the support area of 1.0927 will lead to an increase in the bearish trend.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20