EUR / USD

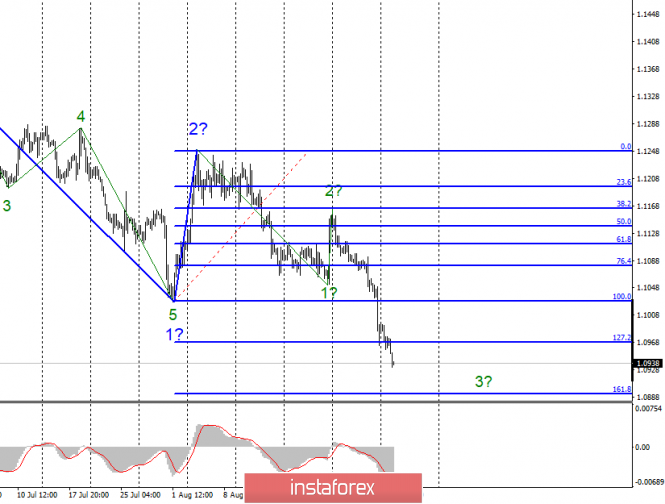

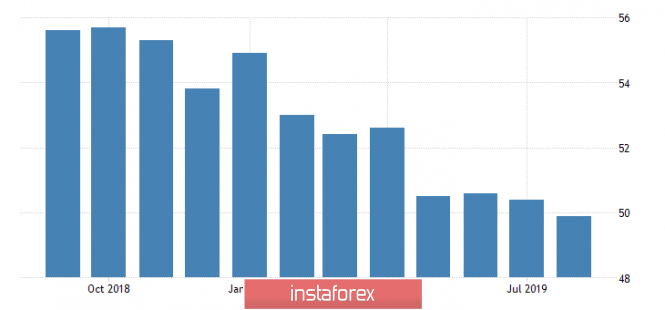

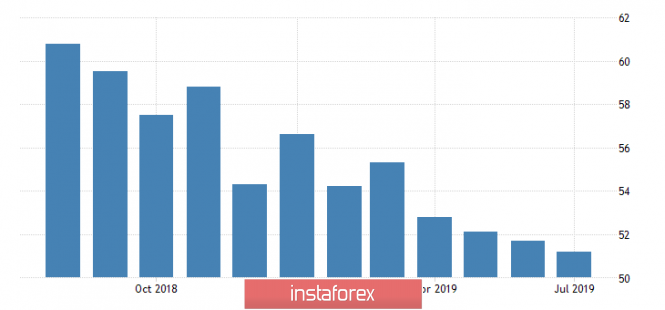

Monday, September 2, ended for the EUR / USD pair with a decline of another 20 basis points. Thus, the expected wave 3, in 3 as part of the bearish trend section continues its construction with targets located near the 161.8% Fibonacci level. Yesterday, the index of business activity in the industrial sector in Germany declined from 43.6 to 43.5 points, while the pan-European index did not change compared to July and amounted to 47.0 points. Both indicators are very disappointing, as they indicate a decline in industry and Germany and the EU as a whole. Therefore, the new sales of the euro-dollar pair are not surprising. Today, I look forward to the continuation of the decline of the instrument, at least until the US trading session, during which the index of business activity in industry in America will be released. Forecasts indicate a fall in business activity in the United States, however, the question is how much the ISM and Markit indices will drop. If you look at the values of the indices for the last year, there is no doubt what to expect from these indicators today.

Markit Business Activity Index

ISM Business Activity Index

Any decrease in these indices can lead to the fact that the bears will moderate their fervor a little, and the pair will move on to the construction of an internal correctional wave in the composition of 3, 3.

Purchase goals:

1.1248 - 0.0% Fibonacci

Sales goals:

1.0893 - 161.8% Fibonacci

1.0807 - 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a bearish wave, which is now interpreted as 3, in 3. I recommend selling the pair with targets near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% Fibonacci . An unsuccessful attempt to break through the level of 161.8% may lead to quotes moving away from the minimums reached.

GBP / USD

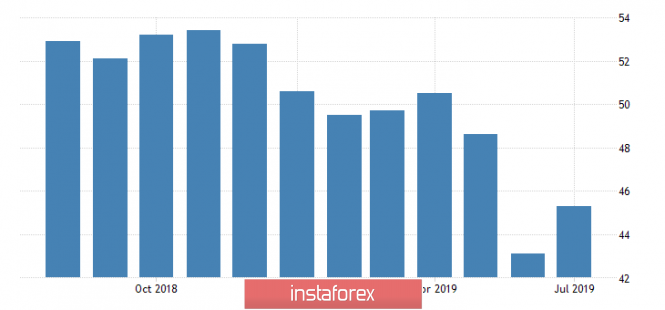

On September 2, the pair GBP / USD lost almost 100 base points and continues to decline within the framework of the expected wave b as part of the construction of the correctional upward trend section. However, with each hour, the probability that wave b does not transform into a new pulsed bearish wave, and that the entire wave marking does not require additions and corrections, is increasingly approaching 0. Already in the next hour or two, the instrument can make a successful attempt to break through the minimum of the expected wave 5, in e. Of course, wave b can go a little beyond the minimum of wave e, after which the construction of ascending c can begin, However, such a wave picture will no longer be "like in a textbook". The news background does predict a new long-term decline in the pound. Today is the first working day of the Parliament after the summer holidays and several crucial issues will be immediately resolved: a vote of confidence in Boris Johnson, and a bill banning Brexit without agreement with Brussels. Markets have little faith that a tough Brexit situation can be fixed, but anything is possible. Also today, the pound sterling has a theoretical chance of increasing. I also draw attention to the index of business activity in the UK construction sector, which is also almost guaranteed to be below 50.0.

Sales goals:

1.2016 - 0.0% Fibonacci

Purchase goals:

1.2306 - 38.2% Fibonacci

1.2401 - 50.0% Fibonacci

General conclusions and recommendations:

The downward section of the trend is previously considered completed. Thus, it is now expected to build an ascending wave with the first targets located near the calculated levels of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes. You can also open purchases by the "up" MACD signal, which is still not there. A successful attempt to break the minimum of August 12 will indicate that the markets are ready for a new fall and will require changes to the current wave pattern.

The material has been provided by InstaForex Company - www.instaforex.com