Last week ended violently, and there was plenty of news. At the same time, investors and traders did not receive fundamental factors, based on which further forecasts can be built. Therefore, markets are driven by fear and uncertainty. Thus, what do we have at the moment?

Speech by the Fed chief disappointed the market participants at Jackson Hole. Jerome Powell did not hint at the possibility of easing politics in September or in the near future, which caused the anger of the American president. At the same time, China announced its own tariffs, the Dow collapsed, and the dollar index experienced an aggressive sale. The USD / JPY and USD / CHF pairs lost almost 1% each. This trend may continue in the coming weeks, as the threat of a recession will increasingly frightened market participants and the Central Bank.

At the G7 meeting in France, Donald Trump caused some confusion, saying that he may have other thoughts on tariffs. The White House later clarified that the American leader regrets that he did not raise tariffs higher. On Monday, the Chinese Deputy Prime Minister called for a solution to the conflict through negotiations.

The trade war has reached a new level. Markets clearly believe that the Fed will now not dodge a more aggressive rate cut, at least in September. Traders, in turn, expect a quarter-point reduction at the next Fed meeting and more than 120 basis points by the end of 2020. The dollar briefly rejoiced at this state of affairs.

Therefore, it is difficult to predict how the plot of the war unleashed by Trump will develop further. One thing is clear - the conflict is escalating. It is worth paying attention to the fact that the dollar index could not gain a foothold above 98 once again. Currently, it is stuck in the active resistance zone of 97.5–98.5. With testing of 97.5, the direction opens to a slight decline to 96.5. If the US currency goes lower, it will mean a high probability of a large downward rally.

One fact is worth mentioning here: the head of the Bank of England, during the symposium in Jackson Hole, proposed abandoning the dollar as a global currency. Boris Johnson, in front of the G7, said he would definitely talk to Trump about the growing concern over trade wars. In other words, officials publicly emphasized the volatility and insecurity of the dollar in the context of US policy. This is a big minus for the dollar.

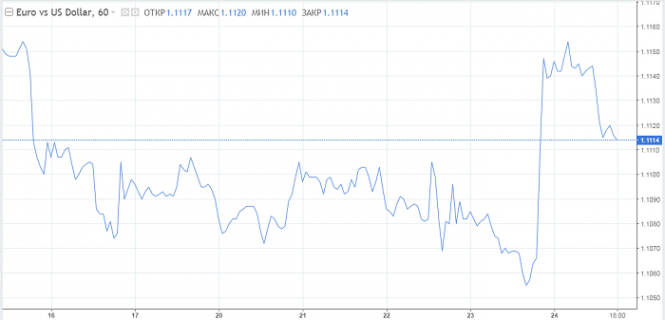

As for the main pair, there are prerequisites for its recovery up to $ 1.13.

On Monday morning, the quotes of EUR / JPY is still declining, acting out the escalation of the trade war, then the correction began. From a technical point of view, the pair has the potential to recover to level 120.

On the other hand, the Japanese yen is likely to be in demand, as there are plenty of reasons for concern in the markets. First of all, this is an escalation of the trade conflict and the situation with the yield of the treasuries. However, the authorities of the Land of the Rising Sun may not like this, and they will attempt to weaken the national currency. So far, the USD / JPY level is far from critical, although the quotes reached the lowest level in three years on Monday. Given what is happening, a new trading range may be formed for USD / JPY, and judging by Barclays' forecasts, it is 100-105.