Forecast for August 28:

Analytical review of currency pairs on the scale of H1:

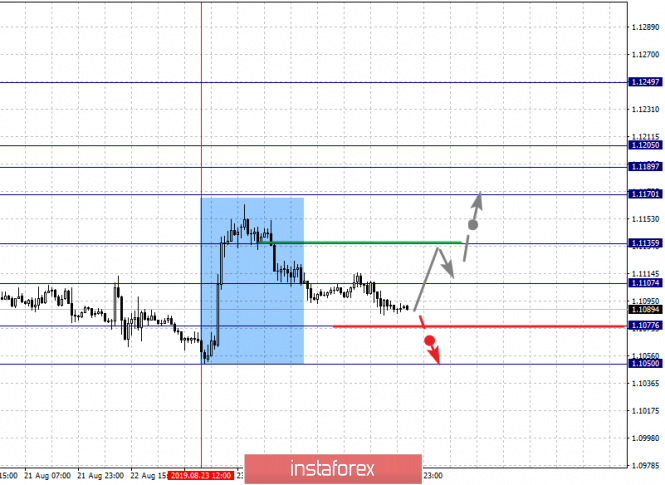

For the euro / dollar pair, the key levels on the H1 scale are: 1.1249, 1.1205, 1.1189, 1.1170, 1.1135, 1.1107, 1.1077 and 1.1050. Here, the price forms a pronounced structure for the top of August 23 and is currently in the correction zone. The continuation of the movement to the top is expected after the breakdown of the level of 1.1135. In this case, the first goal is 1.1170. The breakdown of which will allow us to count on movement to the level of 1.1189, where consolidation is near this value. The passage of the price at the noise range 1.1189 - 1.1205 should be accompanied by a pronounced upward movement. Here, the goal is 1.1249. We expect a pullback to this level from this level.

Consolidated movement is expected in the range of 1.1107 - 1.1077. Hence, the probability of a turn to the top is high. The breakdown of the level of 1.1077 will lead to the development of a downward movement. In this case, the target is 1.1050.

The main trend is the ascending structure of August 23.

Trading recommendations:

Buy 1.1135 Take profit: 1.1170

Buy 1.1172 Take profit: 1.1189

Sell: 1.1075 Take profit: 1.1052

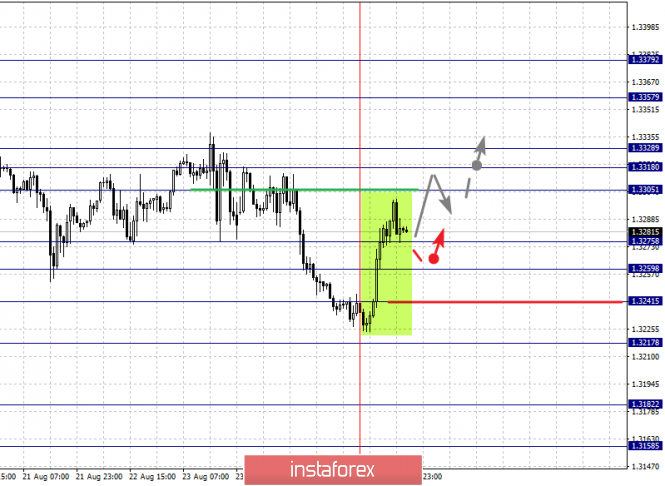

For the pound / dollar pair, the key levels on the H1 scale are: 1.2425, 1.2372, 1.2345, 1.2302, 1.2254, 1.2224 and 1.2183. Here, we specified the key objectives for the ascending structure of August 20. The continuation of the movement to the top is expected after the breakdown of the level of 1.2302. In this case, the target is 1.234. Price consolidation is in the range of 1.2345 - 1.2372. For the potential value for the top, we consider the level of 1.2425. Upon reaching this value, we expect a pullback to the bottom.

Short-term downward movement is expected in the range of 1.2254 - 1.2224. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.2183. This level is a key support for the top.

The main trend is the local structure for the top of August 20.

Trading recommendations:

Buy: 1.2302 Take profit: 1.2345

Buy: 1.2372 Take profit: 1.2425

Sell: 1.2253 Take profit: 1.2225

Sell: 1.2222 Take profit: 1.2183

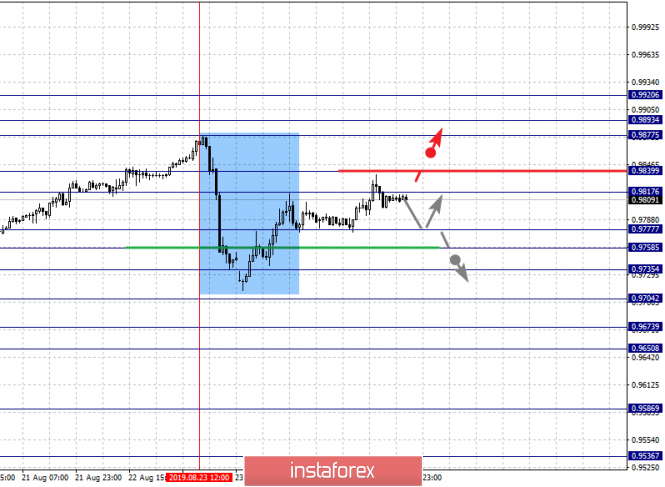

For the dollar / franc pair, the key levels on the H1 scale are: 0.9920, 0.9893, 0.9877, 0.9839, 0.9817, 0.9777, 0.9756, 0.9704, 0.9673, 0.9650 and 0.9586. Here, the price is in equilibrium: the downward structure of August 23, as well as the formation of the potential for the top of August 26. Short-term downward movement is expected in the range of 0.9777 - 0.9758. The breakdown of the latter value will lead to a movement to the level of 0.9735, where consolidation is near this level. The breakdown of the level of 0.9735 will lead to the development of a downward structure from August 23. In this case, the first target is 0.9704.

Short-term upward movement is possibly in the range of 0.9817 - 0.9839. The breakdown of the latter value will lead to the development of the ascending structure from August 26. Here, the target is 0.9877. Price consolidation is in the range of 0.9877 - 0.9893. For the potential value for the top, we consider the level of 0.9920. Upon reaching which, we expect a pullback to the bottom.

The main trend is the equilibrium situation.

Trading recommendations:

Buy : 0.9817 Take profit: 0.9836

Buy : 0.9842 Take profit: 0.9875

Sell: 0.9777 Take profit: 0.9760

Sell: 0.9756 Take profit: 0.9735

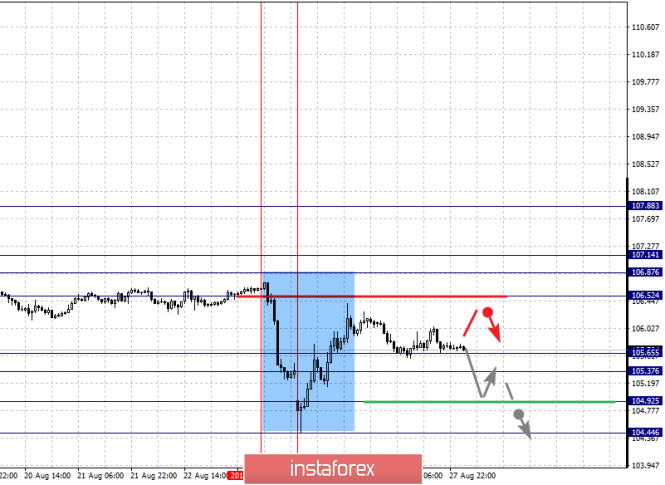

For the dollar / yen pair, the key levels on the scale are : 107.88, 107.14, 106.87, 106.52, 105.65, 105.37, 104.92 and 104.44. Here, the price is in equilibrium: the descending structure of August 23, as well as the ascending structure of August 26. The continuation of the movement to the top is expected after the breakdown of the level of 106.52. In this case, the target is 106.87, where consolidation is near this level. The passage of the price at the noise range 106.87 - 107.14 should be accompanied by a pronounced upward movement. Here, the potential target is 107.88. Consolidation is near this level.

Short-term downward movement is possibly in the range of 105.65 - 105.37. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first goal is 104.92. For the potential value for the bottom, we consider the level of 104.44, where consolidation is near this level.

The main trend: the equilibrium situation: the descending structure of August 23, as well as the ascending structure of August 26.

Trading recommendations:

Buy: 106.52 Take profit: 106.85

Buy : 107.15 Take profit: 107.88

Sell: 105.35 Take profit: 104.94

Sell: 104.90 Take profit: 104.46

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3357, 1.3328, 1.3318, 1.3305, 1.3275, 1.3259, 1.3241 and 1.3217. Here, the price forms a pronounced potential for the upward movement of August 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.3305. In this case, the target is 1.3318. Consolidation is near this level. The passage of the price at the noise range 1.3318 - 1.3328 should be accompanied by a pronounced upward movement. Here, the target is 1.3357. For the potential value for the top, we consider the level of 1.3379. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.3275 - 1.3259. The breakdown of the last value will lead to a long correction. Here, the target is 1.3241. This level is a key support for the upward structure. Its passage at the price will lead to the development of a downward movement. In this case, the first potential target is 1.3217.

The main trend is the formation of potential for the top of August 27.

Trading recommendations:

Buy: 1.3305 Take profit: 1.3318

Buy : 1.3328 Take profit: 1.3357

Sell: 1.3275 Take profit: 1.3262

Sell: 1.3257 Take profit: 1.3241

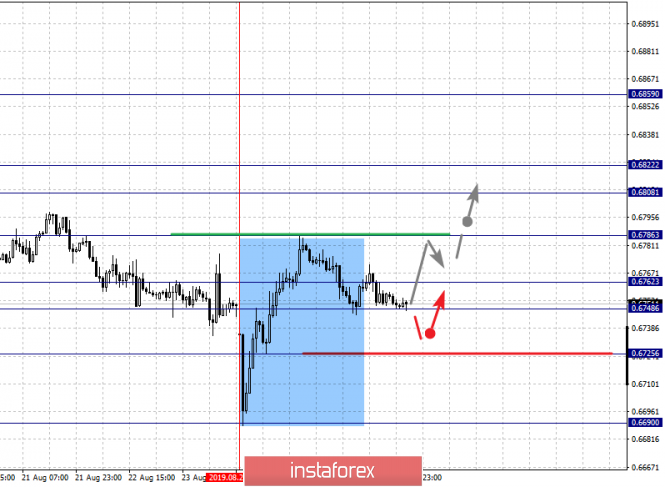

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6859, 0.6822, 0.6808, 0.6786, 0.6762, 0.6748 and 0.6725. Here, we are following the formation of the ascending structure of August 26. The continuation of the movement to the top is expected after the breakdown of the level of 0.6786. In this case, the target is 0.6808. Short-term upward movement, as well as consolidation is in the range of 0.6808 - 0.6822. The breakdown of the level of 0.6822 should be accompanied by a pronounced upward movement. Here, the target is 0.6859, where consolidation is near this level, as well as a pullback to the bottom.

Consolidated movement is possibly in the range of 0.6762 - 0.6748. The breakdown of the last value will lead to a long correction. Here, the target is 0.6725. This level is a key support for the ascending structure.

The main trend is the formation of the ascending structure of August 21.

Trading recommendations:

Buy: 0.6786 Take profit: 0.6808

Buy: 0.6809 Take profit: 0.6820

Sell : 0.6745 Take profit : 0.6728

Sell: 0.6722 Take profit: 0.6695

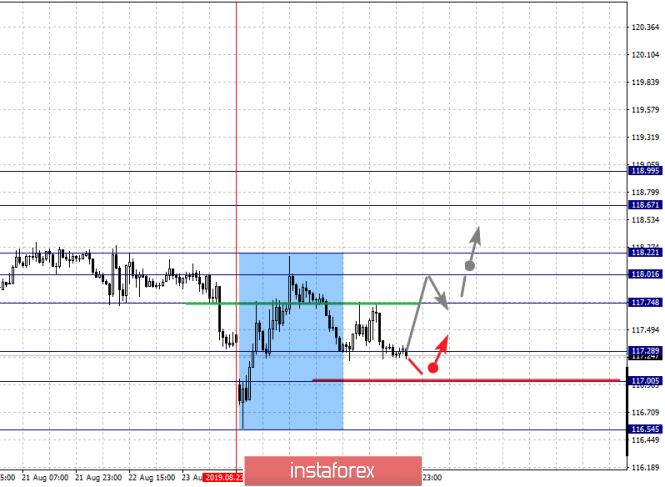

For the euro / yen pair, the key levels on the H1 scale are: 118.99, 118.67, 118.22, 118.01, 117.74, 117.28, 117.00 and 116.54. Here, the price forms the potential for the top of August 23. The continuation of the upward movement is expected after the breakdown of the level of 117.74. In this case, the first target is 118.01. The passage at the price of the noise range 118.01 - 118.22 will lead to a pronounced movement. In this case, the target is 118.67, where consolidation is near this level. For the potential value for the top, we consider the level of 118.99. Upon reaching this level, we expect a pullback to the bottom.

The range of 117.28 - 117.00 is a key support for the upward structure. Its passage at the price will favor the development of a downward movement. In this case, the first potential target is 116.54.

The main trend is the downward cycle of August 13, the formation of the potential for the top of August 23.

Trading recommendations:

Buy: 117.75 Take profit: 118.01

Buy: 118.22 Take profit: 118.65

Sell: 117.28 Take profit: 117.05

Sell: 117.00 Take profit: 116.55

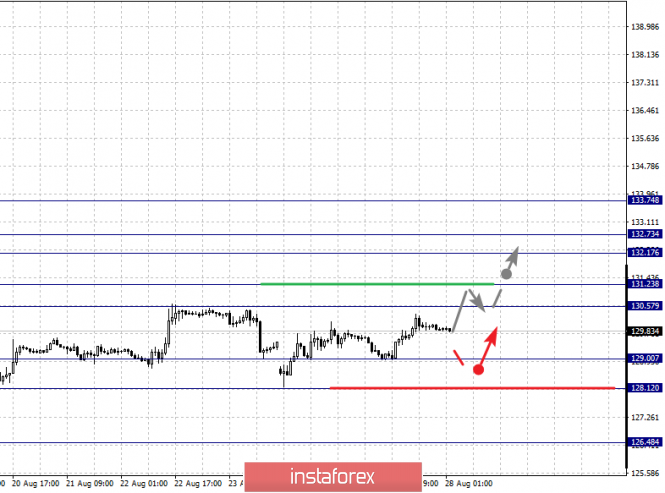

For the pound / yen pair, the key levels on the H1 scale are : 133.74, 132.73, 132.17, 131.23, 130.57, 129.00 and 128.12. Here, we follow the development of the ascending structure of August 12. Short-term upward movement is expected in the range of 130.57 - 131.23. The breakdown of the latter value will lead to a pronounced upward movement. Here, the target is 132.17. Short-term upward movement, as well as consolidation is in the range of 132.17 - 132.73. For the potential value for the top, we consider the level of 133.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

The range of 129.00 - 128.12 is the key support for the ascending structure of August 12. The breakdown of the level of 128.12 will favor the development of the downward movement. In this case, the first potential target is 126.48.

The main trend is the ascending structure of August 12.

Trading recommendations:

Buy: 130.58 Take profit: 131.23

Buy: 131.26 Take profit: 132.17

Sell: 128.96 Take profit: 128.12

Sell: 128.10 Take profit: 126.55

The material has been provided by InstaForex Company - www.instaforex.com