Greetings, crypto enthusiasts and crypto-hamsters, a week has passed since our last review, and the course of the first cryptocurrency, strictly speaking, remained in the same place. What is the reason for such an attractive platform? A return to the $ 10,000 level was facilitated by a layer of negative information that has been holding us back for more than a week. The large-scale crypto pyramid PlusToken began to move its capital after law enforcement agencies became interested in it. By the way, a considerable amount of funds is involved in the form of moving $ 2 billion, and the fact that they can start to merge them somewhere, leaving customers' deposits empty, certainly scares traders. The second injection factor was inspired from the United States,

I can't say that this background exerted tremendous pressure during the intervals of the past week, but the restraint of the leading cryptocurrency is clearly visible.

Digest of bygone days:

Arcane Research conducted a study of the dominance of Bitcoin in the crypto industry. According to company analysts, CoinMarketCap statistics regarding total market capitalization (dominance) are not true, and the level of 69% is underestimated, since the actual share of bitcoin in the market can exceed 90%.The British court to some extent recognized Bitcoin as property. This conclusion came as a result of the trial of the theft of 100 BTC. In UK law, cryptocurrency is considered data, so the owner cannot demand its return in case of theft. However, the lawyers in this case were able to prove to the judge that the theft was not a transfer of ownership. Now the court is awaiting the conclusion of a working group, which should determine by the end of August whether it is legal to recognize Bitcoin as property.Bank of England head Mark Carney said central banks should consider joining forces to create a virtual currency that could replace the dollar as a reserve currency. We hear such phrases from crypto enthusiasts quite often, but not from the heads of the Central Bank, and after that it's worth considering.American congressmen visited Switzerland, where they met with experts from the Federal Office for the Protection of Data and Information regarding cryptocurrency from Facebook (Libra). Upon returning, the chairman of the US financial services committee, Maxine Waters, said, "Swiss government officials helped understand Facebook's status, complexity and scope, but I'm still worried about letting the big tech company create an alternative global currency controlled by the private sectors.A federal court in the Southern District of Florida decided to recover a staggering amount of bitcoins from the self-proclaimed Satoshi Nakamoto. The Kleiman v. Wright case ended in defeat, the court decided to recover from the Australian Craig Wright more than half a million bicoins and intellectual property rights that he owned until 2014, the relatives of the deceased Dave Kleiman, who is associated with the creation of the first cryptocurrency . According to a conservative estimate, this is around $ 5.5 billion, of which Kleiman's relatives must pay a tax of 40% of the amount awarded. Now Craig has the opportunity to appeal, which, of course, he will do, and the process will drag on for a long time, but just imagine if the court nevertheless takes the side of Kleiman and they decide to sell part of these bitcoins to pay taxes.To summarize the information background, and what we see is a lot of rich information that is individual and reacts differently to the crypto industry. In general terms, the pressure remains on the market after all, which reflects the market chart, but you should pay tribute to the stability of the leading cryptocurrency.

What we have now is the amplitude fluctuation around 7.5% BTC, where the quote is concentrated within the psychological level of $ 10,000.

What are the assumptions for further development?

The bulk of traders is still not ready for growth, maybe the fear factor of last year (2018) plays when, at the same time period, the end of summer, a round of Bitcoin drain began. At the moment, the limits of 9800/10500 (11000) are retained in the market, whether to work within the range, yes, it is possible, but the risk is high. The most acceptable tactic is still waiting for the breakdown of these boundaries.

Key coordinates for the upward stroke: 12330; 13130; 13970. Key coordinates for the downward course: 10000; 9100; 7500.

The general background of the cryptocurrency market

Analyzing the general market capitalization, we see that the market volume continues to sluggish fluctuation in the side channel 256-282 ($ billion). Compared with the previous article, capitalization fell by another $ 12.7 billion and currently amounts to $ 263.6 billion. If we consider the volume chart in general terms, then the current ceilings remain the same: $ 355.1 billion and $ 385.2 billion.

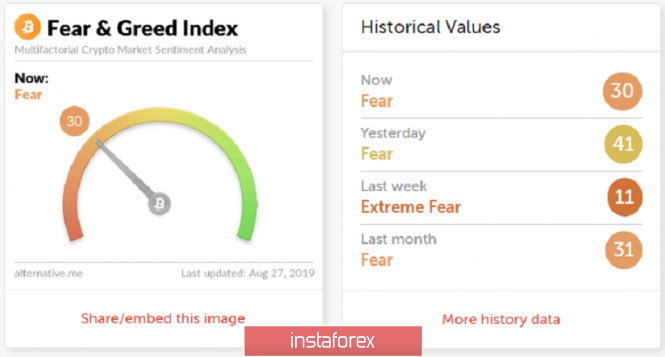

The index of emotions, aka fear and euphoria of the crypto market, fell from 39p. up to 30p., which reflects the indecision of traders and the fear of decline. That week, the index fell to an extremely low level of 5, which once again confirms the fear of traders in the form of a fear of a repeat of last year.

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators on all major time periods signal a possible decrease. It is worth taking into account such a moment that now the quote moves in the side channel, does not fall, and thus the indicators on the minute and intraday periods can be variable, consider this in the analysis.

The material has been provided by InstaForex Company - www.instaforex.com