The US dollar was able to regain momentum over the Swiss franc. The greenback was trading below 0.9700. Ahead of the NFP report this week, the US currency may extend its gains. However, some analysts think that the US dollar is unlikely to set a long-term rally.

Trade wars put pressure on the US economy. The Fed is considering to lower its key rate. The greenback is likely to be quite volatile ahead of the Fed's meeting. The Swiss franc fell considerably after the Swiss government declared to ban Swiss shares on EU exchanges. This news had a negative impact on the bullish sentiment of CHF buyers. A skirmish over stock market access between Switzerland and the European Union risks escalating into a broader political battle over sovereignty that could do lasting damage to relations.

The CHF Retail Sales report has been recently published. It showed a decrease to -1.7% from the previous value of -0.8% which was expected to grow to 0.6%. The Swiss CPI report will be published tomorrow. The reading is also expected to indicate a drop to -0.1% from the previous value of 0.3%.

What is more, the US dollar is pressurized by uncertainty over the key rate decision. Donald Trump constantly criticizes the Fed's approach to monetary policy. Recently, White House trade adviser Peter Navarro blamed the Fed's rate hike for the economic slowdown and expect the Fed to cut the rates to get everything back in track. Fed's Mester expressed skepticism that a US interest rate cut is the right move until there are more signs the economy is moving to a truly weaker path. Markets are also widely expecting the central bank's next move will be a cut by its July 30-31 policy meeting in light of weaker inflation and uncertainties including a US-China trade war. After its most recent meeting, the Fed last month released economic projections revealing that nearly half of the 17 policymakers now showed a willingness to lower borrowing costs over the next six months.

Ahead of the NFP report, the US ISM Non-manufacturing PMI report is going to be published. The reading is expected to fall to 56.1 from the previous figure of 56.9 and the ADP Non-Farm Employment Change is expected to grow to 140k from the previous figure of 27k. Moreover, US Factory Orders report is also expected to show an increase to -0.4% from the previous value of -0.8%.

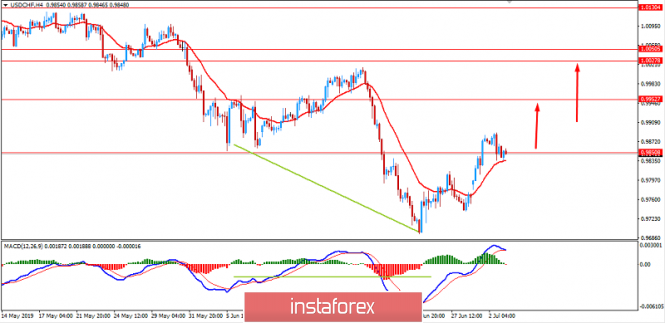

Now let us look at the technical view. The price is currently residing above the 0.9850 area after breaking and retesting the area with strong bullish momentum supported by the dynamic level of 20 EMA. It is expected to push higher towards 1.00 area in the coming days. As the price remains above 0.97 area with a daily close, further upward pressure is likely to occur.