Forecast for July 2:

Analytical review of H1-scale currency pairs:

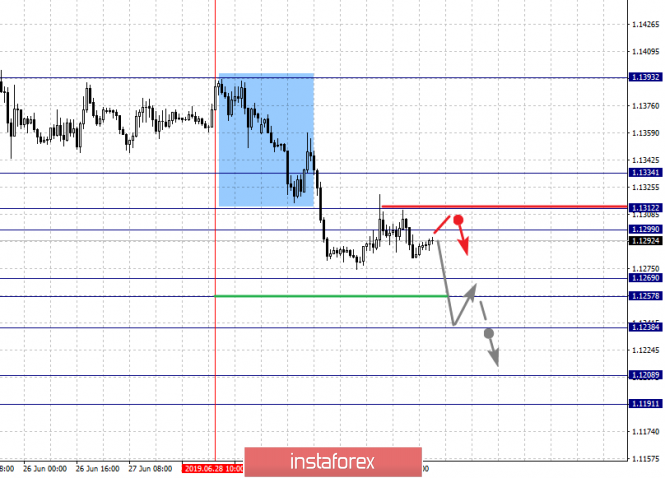

For the euro / dollar pair, the key levels on the H1 scale are: 1.1334, 1.1312, 1.1299, 1.1269, 1.1257, 1.1238, 1.1208 and 1.1191. Here, the next targets for the downward movement are determined from the local structure on June 28th. Continuation of the movement to the bottom is expected after the price passes the noise range 1.1269 - 1.1257. In this case, the goal is 1.1238. Price consolidation is near this level. Breakdown at level 1.1236 will allow us to count on a pronounced movement to the level of 1.1208. For the potential value for the bottom, we consider the level of 1.1191, after reaching which, we expect a rollback to the top.

Short-term upward movement is possible in the corridor 1.1299 - 1.1312. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 1.1334. This level is a key support for the downward structure.

The main trend - a local downward structure of June 28.

Trading recommendations:

Buy 1.1300 Take profit: 1.1311

Buy 1.1313 Take profit: 1.1334

Sell: 1.1257 Take profit: 1.1238

Sell: 1.1236 Take profit: 1.1210

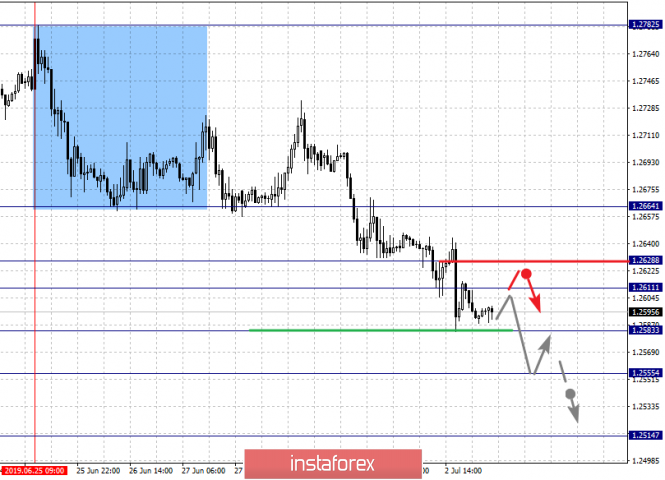

For the pound / dollar pair, the key levels on the H1 scale are: 1.2664, 1.2628, 1.2611, 1.2583, 1.2555 and 1.2514. Here, we are following the development of the downward structure of June 25th. Continuation of the movement to the bottom, is expected at level 1.2583 after the breakdown. In this case, the target is 1.2555. Consolidation is near this level. For the potential value to the bottom, we consider the level of 1.2514, after reaching which, we expect to go into a correction.

Short-term upward movement is expected in the corridor 1.2611 - 1.2628. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2664. This level is a key support for the downward structure.

The main trend - the downward structure of June 25.

Trading recommendations:

Buy: 1.2611 Take profit: 1.2626

Buy: 1.2630 Take profit: 1.2664

Sell: 1.2581 Take profit: 1.2557

Sell: 1.2553 Take profit: 1.2516

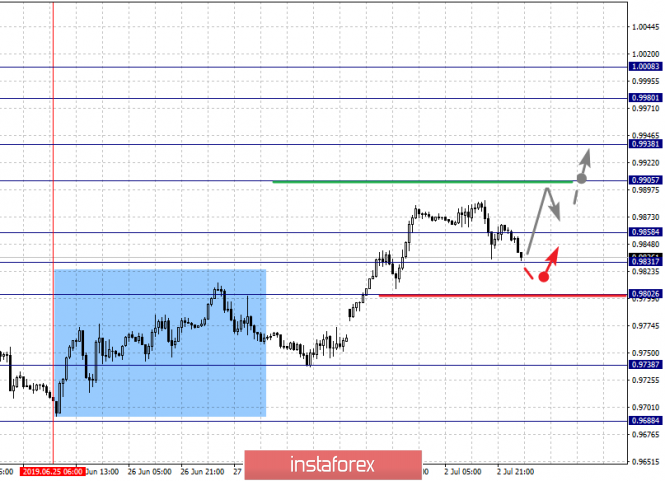

For the dollar / franc pair, the key levels on the H1 scale are: 1.0008, 0.9980, 0.9938, 0.9905, 0.9858, 0.9831 and 0.9802. Here, we continue to follow the development of the upward cycle from June 25. At the moment, the price is in the correction. Continuation of the movement to the top is expected after the breakdown of 0.9905. In this case, the target is 0.9938. Price consolidation is near this level. The breakdown of the level of 0.9938 should be accompanied by a pronounced upward movement. Here, the target is 0.9980. For the potential value to the top, we consider the level of 1.0008, after reaching which, we expect consolidation, as well as a rollback to the correction.

Consolidated movement is possible in the corridor 0.9858 - 0.9831. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 0.9802. This level is a key support for the top. Its price will have to develop the downward structure. Here, the potential goal is 0.9738.

The main trend is the ascending cycle of June 25.

Trading recommendations:

Buy : 0.9905 Take profit: 0.9936

Buy : 0.9939 Take profit: 0.9980

Sell: 0.9829 Take profit: 0.9802

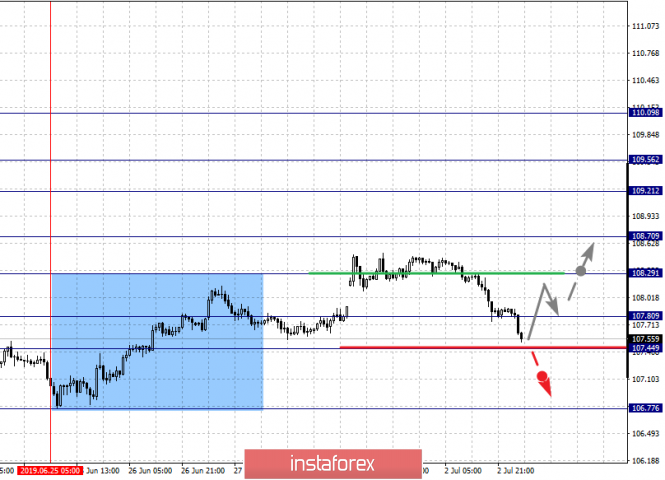

For the dollar / yen pair, the key levels on the scale are : 110.09, 109.56, 109.21, 108.70, 108.29, 107.80, 107.44 and 106.77. Here, we continue to follow the development of the upward structure from June 25. At the moment, the price is in deep correction and is close to canceling this structure, for which a breakdown of the level of 107.44 is necessary. In this case, the potential target is 106.77. Continuation of the movement to the top is expected after the breakdown of 108.29. Here, the first goal is 108.70. The breakdown of which will allow us to expect to move to level 109.21. Short-term upward movement and consolidation is in the corridor 109.21 - 109.56. For the potential value to the top, we consider the level of 110.09. The movement to which is expected at level 109.56 after the breakdown.

The main trend: the ascending structure of June 25, the stage of deep correction.

Trading recommendations:

Buy: 108.30 Take profit: 108.70

Buy : 108.74 Take profit: 109.20

Sell: 107.41 Take profit: 107.00

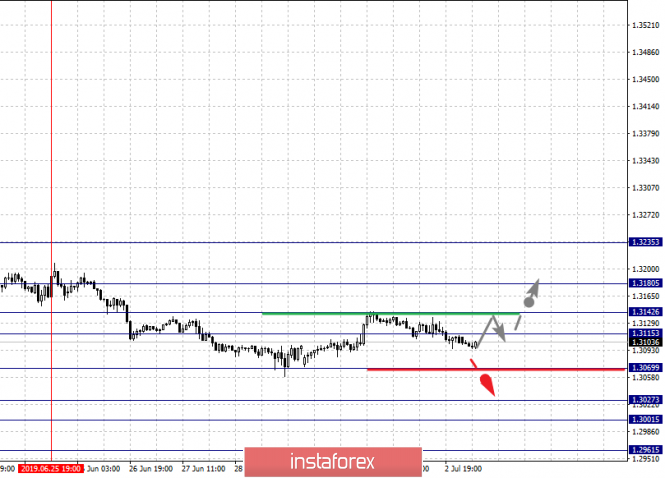

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3180, 1.3142, 1.3115, 1.3069, 1.3027, 1.3001 and 1.2961. Here, we continue to monitor the local downward structure of June 25, at the moment the price is in the correction zone. Continuation of the movement to the bottom is expected after the breakdown at level 1.3069. In this case, the goal is 1.3027. Price consolidation is in the corridor 1.3027 - 1.3001. For the potential value to the bottom, we consider the level of 1.2961, after reaching which, we expect a rollback to the top.

Short-term upward movement is possible in the corridor 1.3115 - 1.3142. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3180. This level is the key resistance for the development of the upward structure. Its breakdown will allow to count on movement towards the potential target - 1.3235.

The main trend is a local downward structure from June 25.

Trading recommendations:

Buy: 1.3143 Take profit: 1.3180

Buy : 1.3182 Take profit: 1.3230

Sell: 1.3067 Take profit: 1.3027

Sell: 1.3001 Take profit: 1.2961

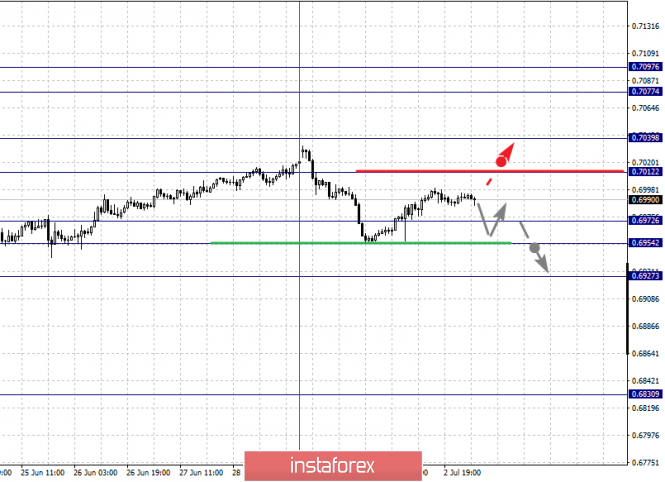

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7097, 0.7077, 0.7039, 0.7012, 0.6972, 0.6954 and 0.6927. Here, we are following the development of the ascending structure of June 18. At the moment, the price is in correction and forms the potential movement for the downward movement of June 28. Continuation of the movement to the top is expected after the breakdown of the level of 0.7012. In this case, the goal is 0.7039. Price consolidation is near this level. The breakdown of the level 0.7040 must be accompanied by a pronounced upward movement. Here, the goal is 0.7077. For the potential value to the top, we consider the level of 0.7097. Upon reaching this level, we expect a consolidated movement in the corridor of 0.7077 - 0.7097, as well as a rollback to the bottom.

Consolidated movement is possible in the corridor 0.6972 - 0.6954. Breaking the last value will lead to a prolonged correction. Here, the target is 0.6927. This level is a key support to the top.

The main trend is the upward structure on June 18. The correction stage is the formation of potential for the bottom of June 28.

Trading recommendations:

Buy: 0.7012 Take profit: 0.7037

Buy: 0.7041 Take profit: 0.7077

Sell: 0.6952 Take profit: 0.6930

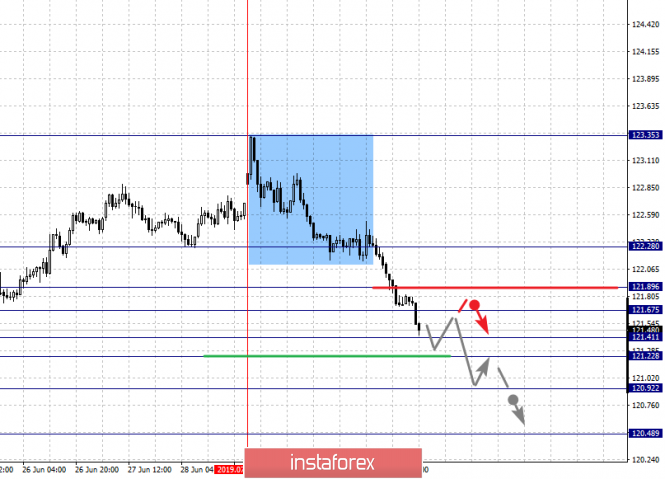

For the euro / yen pair, the key levels on the H1 scale are: 122.28, 121.89, 121.67, 121.41, 121.22, 120.92 and 120.48. Here, the price canceled the development of the ascending structure and at the moment we are following the downward cycle of July 1. Continuation of the movement to the bottom is expected after passing by the price of the noise range 121.41 - 121.22. In this case, the goal is 120.92. Consolidation is near this level. For the potential value to the bottom, we consider the level of 120.48, after reaching which, we expect a rollback to the top.

Short-term upward movement is expected in the corridor 121.67 - 121.89. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 122.28. This level is a key support for the downward structure.

The main trend is the downward cycle of July 1.

Trading recommendations:

Buy: 121.67 Take profit: 121.87

Buy: 121.94 Take profit: 122.28

Sell: 121.22 Take profit: 120.94

Sell: 120.90 Take profit: 120.50

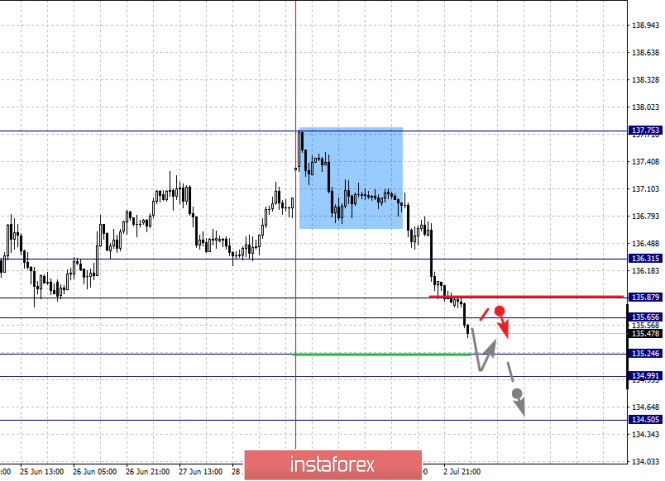

For the pound / yen pair, the key levels on the H1 scale are : 136.31, 135.87, 135.65, 135.24, 134.99 and 134.50. Here, the price has canceled the development of an upward trend. Currently, we are following the downward cycle of July 1. Short-term downward movement is expected in the range of 135.24 - 134.99. The breakdown of the last value will allow to expect movement towards a potential target - 134.50. After reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the range of 135.65 - 135.87. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 136.31. This level is a key support for the downward structure.

The main trend is the downward cycle of July 1.

Trading recommendations:

Buy: 135.65 Take profit: 135.85

Buy: 135.90 Take profit: 136.30

Sell: 135.24 Take profit: 135.00

Sell: 134.95 Take profit: 134.50

The material has been provided by InstaForex Company - www.instaforex.com