Surprisingly, the euro-dollar pair did not lose its bullish momentum and continued to show growth at the opening of the last trading week of June. The US currency did not have time to play the "dovish" comments of the Fed representatives, who increased the confidence that the regulator would not stop at a one-time reduction in the interest rate. In addition, the conflict situation with Iran, as well as the ambiguous prospects of the US-China negotiations, are pushing the pair upward to the borders of the 14th figure. However, the current trading week is full of important events that either unfold a pair of 180 degrees or determine the course of the EUR/USD to the area of 1.1410-1.15520.

The Friday jerk of the pair under the curtain of the five-day trading session was due to extremely mild comments by the Fed representatives. Thus, a member of the Board of Governors, Lael Brainard, said interest rates in the future would be "at low" levels, in conditions of downward risks, including those of a political nature. According to Brainard, frustrating statistics indicate the need to mitigate further dynamics of rates. The focus of the Fed will be on inflation indicators, which recently showed "particularly weak growth."

It is worth noting here that Brainard belongs to the so-called "dovish camp" of the Federal Reserve. Therefore, her comments should not have caused much excitement. But first, she has a permanent right to vote at the Fed, and second is her position was more or less shared by the other members of the regulator, who spoke on Friday. For example, Neil Kashkari proposed to reduce the rate by 50 basis points at a time. This idea is not new as it has rather been vigorously discussed among financial experts recently. The need for a soft monetary policy was expressed on Friday by both Mary Daley (FRB San Francisco) and Loretta Mester (FRB Cleveland). At the same time, each of them spoke about the importance of key macroeconomic reports that will add up to a general picture of a fundamental nature.

In this regard, Monday is almost empty: EUR/USD traders can pay attention only to the German indicator of the business environment from the IFO, which has been consistently declining for the past three months. If today shows growth, the euro will receive additional support, especially against the background of the positive dynamics of the PMI indices. Although, according to forecasts, the minimum decline is expected by 0.4 points.

But on Tuesday we will find out data on the growth of the consumer confidence indicator in the United States. After a dynamic two-month growth rate, the indicator can demonstrate a rather sharp decline from the level of 134 points to 132. Also, the indicator of housing sales in the primary market will be published on this day. For the first time in five months, this indicator showed a serious decline of -6.9%, hence the May figure will play an important role. On the contrary to the forecasts, if the indicator will remain in a negative area again, this will negatively affect the "well-being" of the US currency. Also on Tuesday, we will listen to Fed Chairman Jerome Powell. He will take part in the New York Economic Forum, where he will speak about economic prospects and monetary policy.

On Wednesday, all of the attention of EUR/USD traders will be focused on the indicator of the volume of orders for durable goods in the United States. The April figure showed extremely negative dynamics, dropping into the negative area (excluding transport to the zero level). In May, experts predict a minimum growth and the overall figure should rise to 0.0% (from the previous value of -2.15%), excluding transport to 0.1%.

On Thursday, the main macroeconomic news will come from Germany and the United States. In the United States, the final data on the growth of the country's GDP for the first quarter will be published. According to analysts, the indicator will be revised and be released at the level of initial estimates. As for German inflation, here the indicator should demonstrate minimal growth. In this case, the euro will receive significant support.

The most important day of the week is Friday. On this day, the G-20 summit will begin, where a meeting of the leaders of the United States and China will take place and although the summit will last 2 days (that is, we will find out its results already on Saturday), the parties can designate prospects for further relations on the last day of the trading week. Depending on the results of the preliminary negotiations, the market will either increase or weaken anti-risk sentiment. Both the dollar and the euro are awaiting the G-20 summit. Its results will allow traders to adjust expectations regarding the prospects for the Fed's monetary policy. The head of the European Central Bank, Mario Draghi, also focused his attention on the escalation of trade tensions, denoting the likelihood of monetary easing at the last meeting.

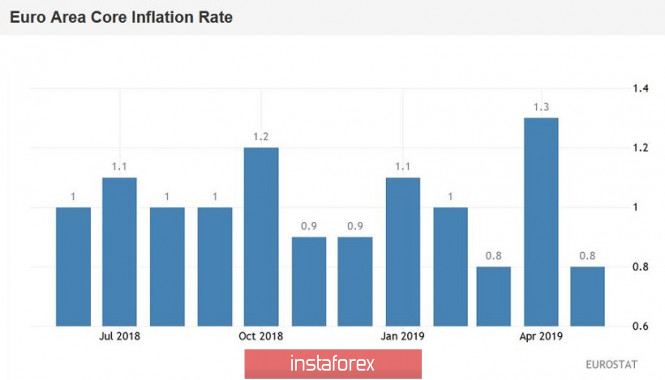

In the context of the EUR/USD pair, volatility will be reinforced by the release of important macroeconomic statistics. First, we find out the data on the growth of European inflation. According to the consensus forecast, the general consumer price index should remain at the April level of 1.2%, whereas core inflation may show growth and return to the 1% mark after falling to 0.8%. The main index of personal consumption expenditures will be published during the American session. He talks about the state of consumer demand in the United States and indirectly affects inflation. According to many experts, this indicator is monitored "especially carefully" by the Fed. In April, the index rose both in annual and monthly terms. But the May figures may be disappointing. Experts predict a fairly significant decline to the zero level on a monthly basis and to 1.

In addition to macroeconomic statistics and the G20 summit, the dynamics of the EUR/USD pair will be affected by the US-Iran conflict, which is still not solved. Over the weekend, the Americans carried out a cyber attack on Iran's computer systems to control the launch of missiles (after Tehran hit an American drone). According to the US military, the operation caused damage to Iran's military command and control systems but did not lead to the death of people or civilian casualties. In turn, the Iranians commented on the situation succinctly stating that "the US cyber attacks were not successful." Further escalation of this conflict will put pressure on the dollar, especially against the background of the "dovish" intentions of the Fed.

In the technical aspect, the EUR/USD pair is still on the upper line of the Bollinger Bands indicator on both the daily and weekly charts, which confirms the priority of the northern movement. If the pair on W1 overcomes the upper line of this indicator, the next resistance level will be at the bottom of the Kumo cloud on the weekly chart, which corresponds to the price of 1.1440.

The material has been provided by InstaForex Company - www.instaforex.com