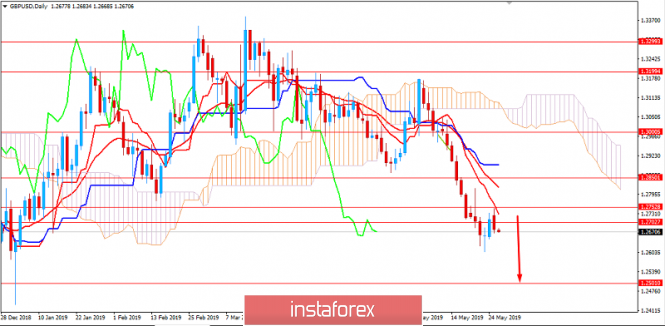

GBP has been the weaker currency in the pair with USD recently, so the price resided below 1.2700 area after certain retest of 1.30 with a daily close.

Brexit had a great impact on Britain's main political parties in the European Parliament elections, with both Conservatives and Labour scoring their worst results in decades as voters opted for politicians with clear pro- and anti-European Union messages. Ms. May has finally given in to pressure from her party and has recently announced that she would quit. But there's little indication that the election will break the deadlock in the Parliament. Conservatives rejected May's deal because it stayed too close to the EU.

Today, the UK High Street Lending report is going to be published which is expected to decrease to 39.3k from the previous figure of 40.0k. Tomorrow, the Nationwide HPI is expected to decrease to 0.0% from the previous value of 0.4%.

On the USD side, China is expected to increase tariffs on US imports worth $60 billion in retaliation for the US decision to hike duties on Chinese imports. Thus, the trade war between the world's two largest economies has escalated that threatens to damage the global economy. The US Prelim GDP report is to be published on Thursday which is expected to decrease to 3.1% from the previous value of 3.2%. Ahead of it, USD is expected to struggle to gain momentum in the process.

Today, the US HPI report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, while the S&P Composite index is expected to increase to 3.1% from the previous value of 3.0%. At the same time, the CB Consumer Confidence is expected to increase to 130.1 from the previous figure of 129.2.

As of the current scenario, the British pound is weaker with the upcoming economic reports and political uncertainty in the country. So, it is expected to lose momentum against USD. At the same time, the US dollar is not in the best shape as well because of the rising trade tensions and increased tariffs of Chinese products which is expected to impact the consumer spending and retail prices in the coming days.

Now let us look at the technical view. The price has recently rejected off the 1.2750 area after certain bullish pressure and the non-volatile bearish trend pressure. Though the dynamic levels are quite far from the current position, the price below 1.30 area with a daily close would indicate further bearish momentum in the coming days with target towards 1.2500 support area.