The USD/CAD pair has been struggling to gain momentum correcting at the edge of 1.3500 area for a few days. The pair is expected to revert to downward pressure after certain gains on the upside.

CAD remains stable amid recent economic reports which helped the currency to stop a sharp increase of USD in the process. Though CAD is still under pressure as trade war concerns have lowered oil prices and have helped the US dollar to sustain the bullish momentum. Recently, Bank of Canada Governor Stephen Poloz said that he was confident the nation's housing sector would return to growth later this year, as markets in Toronto and Vancouver stabilized and the impact of new regulations came into force.

Today, Trade Balance report (CAD) is going to be published which is expected to have positive increase to -2.4B from the previous figure of -2.9B and NHPI to also increase to 0.1% from the previous value of 0.0%.

On the other hand, US-China trade talks have taken a U-turn which remained unsettled recently. President Trump is not quite happy with it. Trump accused China for breaking the deal and threatened to impose additional tariffs on Chinese goods. Escalation of the trade talks are being reflected on the USD market whereas the currency has not been as impulsive as expected due to such drawbacks. Moreover, unemployment rate has improved in the US, while modest inflation indicates a certain possibility of low recession risk.

Today FED Chairman Powell is going to speak about the upcoming monetary policy decision which is expected to be neutral but optimistic for the current economic developments. Additionally, US PPI report is going to be published which is expected to decrease to 0.2% from the previous value of 0.6%, Trade Balance is likely to decrease to -51.4B from the previous figure of -49.4B and unemployment claims might decrease to 215k from the previous figure of 230k.

As of the current scenario, USD has mixed expectation over the upcoming economic reports, while CAD is optimistic. It may lead to further corrections in the process. Any upcoming event on the USD side with positive outcome is expected to lead to certain gains on the upside before CAD regains momentum.

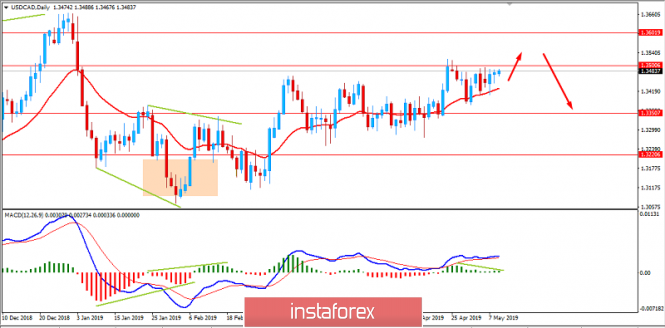

Now let us look at the technical view. The price is being carried by the dynamic level of 20 EMA along the corrections at the edge of 1.3500 area. The price is currently heading towards 1.35-1.36 resistance area from where it is expected to push lower again with target towards 1.3200-1.3350 support area in the coming days. As the price remains below 1.3600 area with a daily close, the chances of bearish trend in the pair is likely to occur.