Analytical review of H1-scale currency pairs:

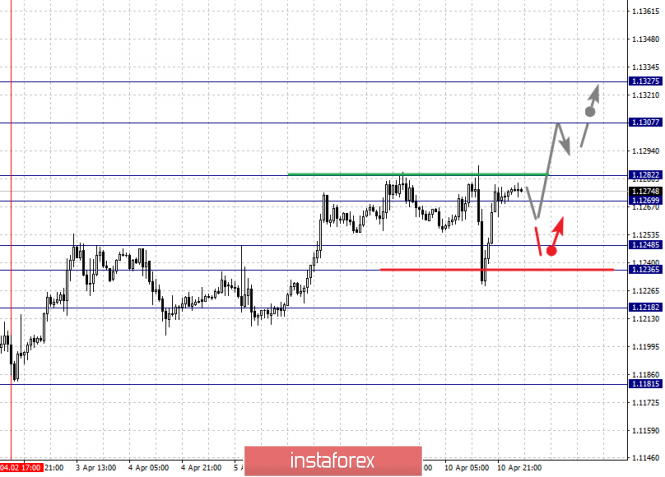

For the euro / dollar pair, the key levels on the H1 scale are: 1.1327, 1.1307, 1.1282, 1.1269, 1.1248, 1.1236 and 1.1218. Here, we continue to monitor the formation of the ascending structure of April 2. Short-term upward movement is expected in the corridor 1.1269 - 1.1282. The breakdown of the latter value will allow us to expect to move to the level 1.1307. For the potential value to the top, we consider the level of 1.1327. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the corridor 1.1248 - 1.1236. Breaking the last value will lead to a prolonged correction. Here, the goal is 1.1218. This level is a key support for the top.

The main trend is the ascending structure of April 2.

Trading recommendations:

Buy 1.1284 Take profit: 1.1305

Buy 1.1309 Take profit: 1.1325

Sell: 1.1248 Take profit: 1.1237

Sell: 1.1234 Take profit: 1.1220

For the pound / dollar pair, the key levels on the H1 scale are: 1.3189, 1.3123, 1.3088, 1.3027, 1.2984, 1.2959, 1.2924 and 1.2876. Here, the price has entered an equilibrium state. Continuation to the bottom is possible after breakdown of 1.3027. In this case, the first target is 1.2984. Short-term downward movement is expected in the corridor 1.2984 - 1.2959. The breakdown of the latter value will lead to the movement to the level of 1.2924. We expect consolidation near this value. For the potential value at the bottom, we consider the level of 1.2876, and from which, we expect the departure of a correction.

Short-term upward movement is possible in the corridor 1.3088 - 1.3123. The breakdown of the latter value will have to develop an upward trend. Here, the first potential target is 1.3189.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3090 Take profit: 1.3120

Buy: 1.3124 Take profit: 1.3187

Sell: 1.3025 Take profit: 1.2987

Sell: 1.2984 Take profit: 1.2960

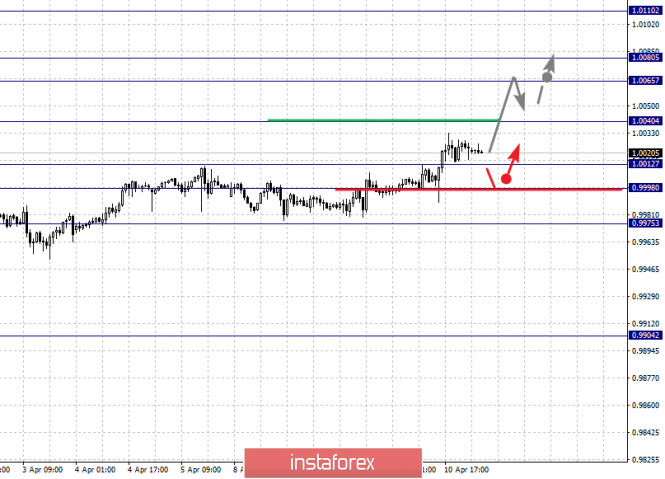

For the dollar / franc pair, the key levels on the H1 scale are: 1.0110, 1.0080, 1.0065, 1.0040, 1.0012, 0.9998 and 0.9975. Here, we continue to follow the development of the ascending cycle of March 27. Continuation of the movement to the top is expected after the breakdown 1.0040. In this case, the goal is 1.0065. Short-term upward movement is in the corridor 1.0065 - 1.0080, as well as consolidation. We consider the level of 1.0110 as a potential value to the top. Upon reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the corridor 1.0012 - 0.9998. The breakdown of the last value will lead to a prolonged correction. Here, the target is 0.9975. This level is a key support for the top.

The main trend - the rising structure of March 27.

Trading recommendations:

Buy: 1.0040 Take profit: 1.0065

Buy: 1.0066 Take profit: 1.0080

Sell: 1.0012 Take profit: 0.9998

Sell: 0.9996 Take profit: 0.9975

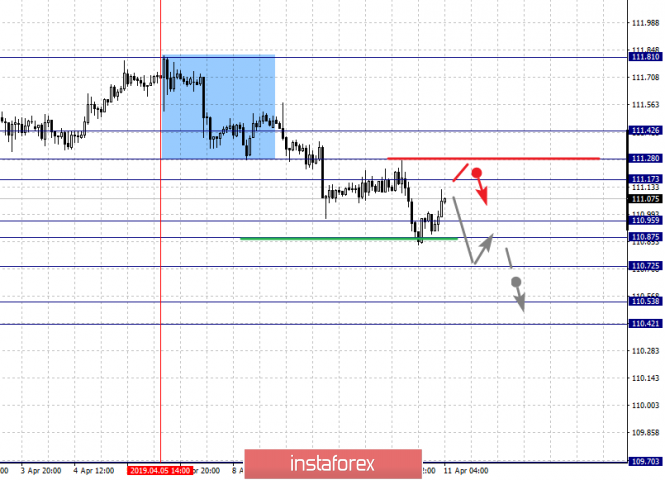

For the dollar / yen pair, the key levels on the H1 scale are : 111.42, 111.28, 111.17, 110.95, 110.87, 110.72, 110.53 and 110.42. Here, we are following the development of the downward structure from April 5th. Continuation of the movement to the bottom is expected after the price passes the noise range 110.95 - 110.87. In this case, the goal is 110.72. Price consolidation is shown near this level. For the potential value at the bottom, we consider the level of 110.42. After reaching which, we expect a consolidated movement in the corridor 110.42 - 110.53, as well as a rollback to the correction.

Short-term upward movement is possible in the corridor 111.17 - 111.28. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 111.42. This level is a key support for the downward structure.

The main trend: the downward structure of April 5.

Trading recommendations:

Buy: 111.17 Take profit: 111.28

Buy: 111.30 Take profit: 111.40

Sell: 110.87 Take profit: 110.74

Sell: 110.70 Take profit: 110.55

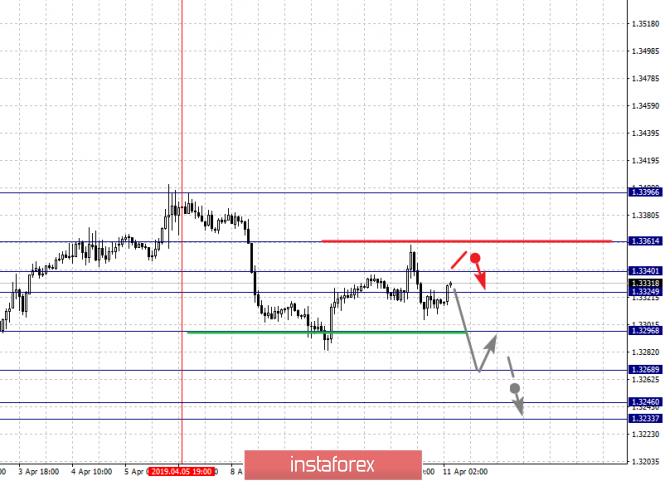

For the Canadian dollar / dollar pair, the key levels on the H1 scale are: 1.3361, 1.3340, 1.3324, 1.3296, 1.3268, 1.3246 and 1.3233. Here, we are following the formation of the downward structure of April 5. At the moment, the price is in the zone of initial conditions. Continuation of the movement to the bottom is expected after the breakdown of 1.3296. In this case, the goal is 1.3268. Consolidation is near this level. For a potential value at the bottom, we consider the level of 1.3233. After reaching which, we expect consolidation in the corridor 1.3246 - 1.3233, as well as a departure to the correction.

Consolidated movement is possible in the range of 1.3324 - 1.3340. The breakdown of the latter value will lead to the development of a prolonged correction. Here, the target is 1.3360. This level is a key support for the downward structure.

The main trend - the formation of the downward potential of April 5.

Trading recommendations:

Buy: 1.3342 Take profit: 1.3360

Buy: 1.3363 Take profit: 1.3394

Sell: 1.3294 Take profit: 1.3268

Sell: 1.3266 Take profit: 1.3246

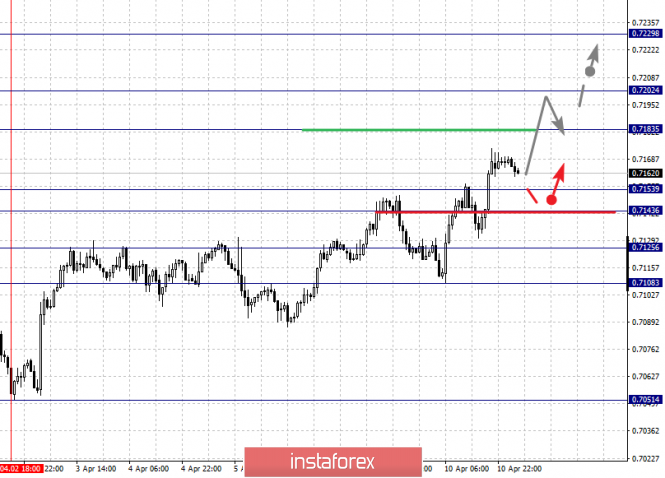

For the Australian dollar / dollar key a levels on the H1 scale are : 0.7229, 0.7202, 0.7183, 0.7153, 0.7143, 0.7125 and 0.7108. Here, we continue to follow the development of the ascending structure from April 2. Continuation of the movement to the top is expected after the breakdown 0.7183. In this case, the goal is 0.7202. Consolidation is near this level. The breakdown of the level of 0.7202 will lead to the movement to the potential target - 0.7229, upon reaching this value, we expect to go into a correction.

Short-term downward movement is possible in the range of 0.7153 - 0.7143. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7125. This level is a key support to the top. Its breakdown will have to form the initial conditions for the downward cycle. In this case, the target is 0.7108.

The main trend is the ascending cycle of April 2.

Trading recommendations:

Buy: 0.7183 Take profit: 0.7200

Buy: 0.7204 Take profit: 0.7225

Sell: 0.7153 Take profit: 0.7144

Sell: 0.7141 Take profit: 0.7127

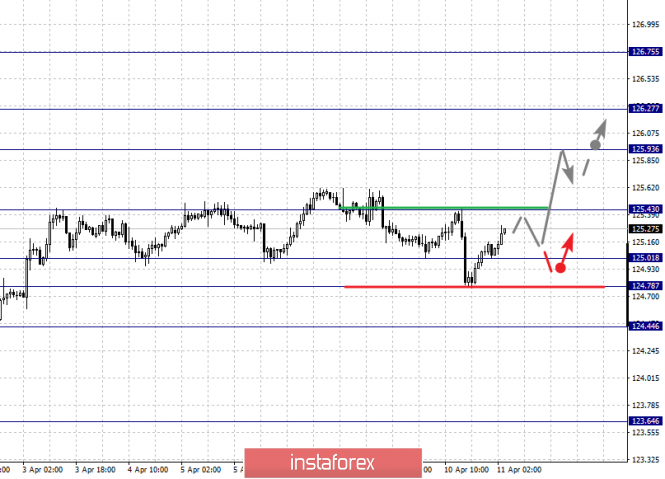

For the euro / yen pair, the key levels on the H1 scale are: 126.75, 126.27, 125.93, 125.43, 125.01, 124.78 and 124.44. Here, we are following the development of the March 28 upward cycle. For the continuation of the movement to the top, we expect 125.45 after the breakdown. In this case, the target is 125.93. Short-term upward movement is in the corridor 125.93 - 126.27, as well as consolidation. For the potential value for the top, we consider the level of 126.75. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the corridor 125.01 - 124.78. The breakdown of the latter value will lead to a prolonged correction. In this case, the target is 124.44. This level is a key support for the top.

The main trend is the upward cycle of March 28, the stage of correction.

Trading recommendations:

Buy: 125.45 Take profit: 125.90

Buy: 125.95 Take profit: 126.20

Sell: 125.00 Take profit: 124.80

Sell: 124.75 Take profit: 124.50

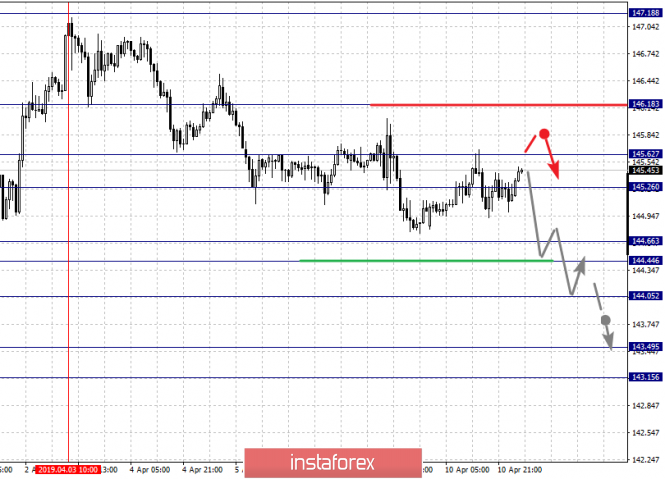

For the pound / yen pair, the key levels on the H1 scale are : 146.18, 145.62, 145.26, 144.66, 144.44, 144.05, 143.49 and 143.15. Here, we are following the development of the downward cycle of April 3. Continuation of the movement to the bottom is expected after the price passes the noise range 144.66 - 144.44. In this case, the goal is 144.05. Consolidation is near this level. Breakdown of 144.05 should be accompanied by a pronounced downward movement to the level of 143.49. For the potential value at the bottom, we consider the level of 143.15. After reaching which, we expect consolidation, as well as rollback to the top.

Short-term upward movement is possible in the corridor 145.26 - 145.62. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 146.18. This level, is a key support for the top.

The main trend is the downward cycle of April 3rd.

Trading recommendations:

Buy: 145.26 Take profit: 145.60

Buy: 145.70 Take profit: 146.15

Sell: 144.44 Take profit: 144.10

Sell: 144.00 Take profit: 143.55

The material has been provided by InstaForex Company - www.instaforex.com