The Federal Reserve kept its official funds rate unchanged at 2.50%. The policy statement reads that there will be no rate hikes in 2019. This agenda was unveiled at the press conference of Jerome Powell. Fed's dovish rhetoric made USD lose further momentum against CHF. USD is likely to extend a decline across the board.

The US Federal Reserve is going to take a patient approach for the whole 2019 year keeping a scope for further increase in 2021. Besides, the FED posed a less aggressive intention to ease a pace of monthly tapering its holdings of Treasury Bonds. Fed's dovish tone dealt a blow to USD which is expected to extend weakness in the coming days. Additionally, FED's balance sheet shrinking is also a part of adjusting to global fluctuations whereas the inflation is also projected to decrease to 1.8%, downgraded from 1.9% in the previous forecast.

Today US Philly Fed Manufacturing Index report is going to be published which is expected to increase to 4.6% from the previous negative value of -4.1%, Unemployment Claims is expected to have positive outcome with a decrease to 226k from the previous figure of 229k, CB Leading Index is expected to increase to 0.1% from the previous value of -0.1%, and Natural Gas Storage is expected to grow to -49B from the previous figure of -204B.

On the other hand, Switzerland released positive reports in PPI and Trade Balance. So, CHF managed to gain impulsive momentum over USD. Today, a SNB Monetary Policy Statement and Libor Rate report are going to be published. The Libor rate is expected to be left steady at -0.75%. Moreover, a SNB Press Conference will provide further hints about assessment of Switzerland's economy. The overall tone is most likely to be hawkish according to recent economic projections.

Meanwhile, USD is licking its wounds following the dovish policy update from the FED. On the other hand, CHF has been firm in light of the recent economic reports ahead of the SNB policy meeting today. To sum it up, the pair could trade with higher volatility today. Besides, CHF is most likely to gain further momentum over USD in the coming days.

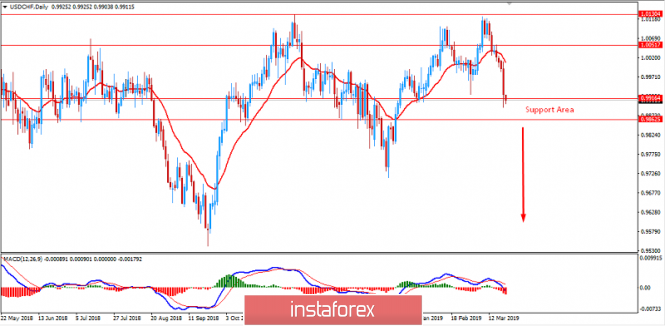

Now let us look at the technical view. The price is currently trading at the edge of 0.9850-0.9920 support area from where a daily close below the area is expected to lead to further bearish pressure with a target towards 0.9500-50 support area. As the price remains below 1.00 area with a daily close, the bearish bias is expected to continue.