AUD having worse Employment Change report has struggled to maintain momentum over JPY in the volatile market atmosphere where it is expected to regain certain momentum as JPY is also struggling with the worse economic outcomes.

Recently, Australian Employment Change report has been published with a significant decrease to 4.6k from the previous figure of 38.3k which was expected to be at 14.8k and Unemployment Rate has showed certain positive outcome of a decrease to 4.9% which was expected to be unchanged at 5.0%. According to the RBA, the indicator measuring Australia's house prices is not the only factor affecting the economy, but there are also other factors. There is a chance of the rate cuts in Australia, if growth and inflation expectations remain strong. Though it is not yet confirmed, because there are certain factors such as income, employment, and consumptions which may bacome a strong barricade for the interest rate cut decision.

Today, Australian Flash Manufacturing PMI report has been published with a slight decrease to 52.0 from the previous figure of 52.9 and Flash Services PMI has increased slightly to 48.8 from the previous figure of 48.7.

On the JPY side, the trade war between the US and China has been affecting the JPY gains and it is expected to persist until the outcome comes into a decision in the coming days. The Japanese economy is heavily based on the exports where Japan's key exports markets, the US and China, have already curbed the world trade resulting in a downturn for the Japanese economy. Most of the Japanese firms are being affected by this downturn in exports and they are pessimistic about the quick resolution. Additionally, the Japan's slowdown of the annual core consumer inflation may force the BOJ to cut its inflation forecasts again. Today, JPY National Core CPI report has been published with a decrease to 0.7% which was expected to be unchanged at 0.8% and Flash Manufacturing PMI has been published unchanged at 48.9 which was expected to increase to 49.2.

As of the current scenario, both currencies in the pair are struggling with the worse economic phase, whereas AUD is quite optimistic until any rate cuts occur in the coming days. Until JPY comes up with a significant positive economic outcome, AUD is expected to regain momentum despite the recent downturn due to the decrease in Employment Change.

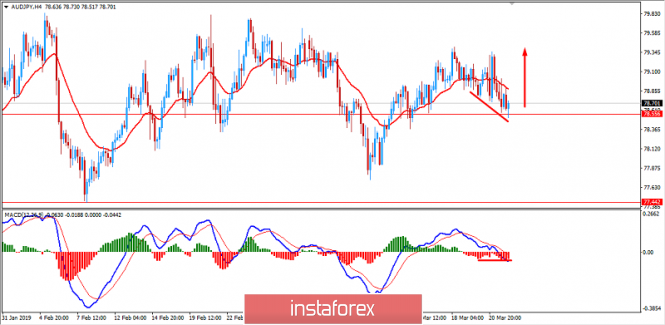

Now let us look at the technical view. The price is currently residing above the 78.50 area after certain retest in the volatile market structure. The price has recently formed Bullish Continuous Divergence which is expected to lead to further bullish momentum in the pair with certain impulsive pressure while remaining above the 78.50 area with the target towards 80.00 to be achieved in the coming days.