USD/JPY has been quite corrective at the edge of 108.50 price area after bouncing off the 104.50 support area recently. Traders are optimistic about USD despite downbeat economic reports published recently. So, USD managed to attract the market sentiment against JPY which might lead to certain USD gains in the coming days.

USD has been weighed down by the recent economic reports and mixed employment results which did weakened the currency. But investor confidence encouraged USD to sustain momentum against JPY. Today US PPI report is going to be published which is expected to decrease to -0.1% from the previous value of 0.1%, Core PPI is expected to decrease to 0.2% from the previous value of 0.3%, Empire State Manufacturing Index is expected to increase to 11.6 from the previous figure of 10.9, and IBD/TIPP Economic Optimism is expected to increase to 53.1 from the previous figure of 52.6. On Thursday, Unemployment Claims report is going to be published which is expected to have a negative result of growth to 218k from the previous figure of 216k and FOMC Member Quarles is scheduled to speak about further monetary policy. The US central bank is widely expected to take a pause in the cycle of monetary tightening in 2019 after four rate hikes in 2018.

On the JPY side, after the observance of Coming of Age Day today M2 Money Stock report was published with an increase to 2.4% as expected from the previous value of 2.3% and Prelim Machine Tool Orders report was published with a decrease to -18.3% from the previous value of -17.0%. Japan's government is currently taking interest in calculation of workers compensation in GDP and may probably revise the draft budget. Though it will hardly have a major impact on the overall growth of the economy, inaccurate wage data makes it difficult to assess or measure the improvements needed. Ahead of Governor Kuroda's speech on Thursday, JPY is going to stay flat before the upcoming economic reports in the coming days.

Meanwhile, both USD and JPY have been quite indecisive amid the economic data. The pair is expected to extend its indecision and correction in the coming days. Because of the upcoming event in Japan on Thursday, any positive outcome from Kuroda's speech is certainly bullish for JPY in the coming days before.

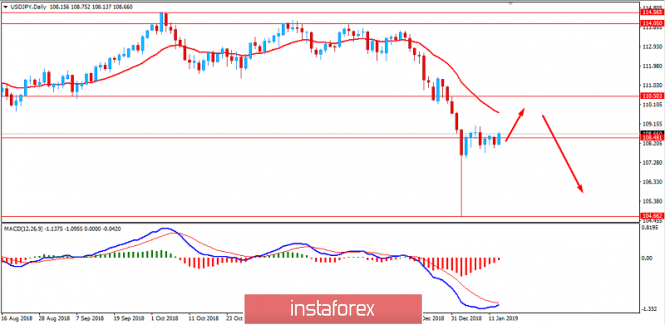

Now let us look at the technical view. The price is currently pushing higher above 108.50 area while also engulfing the previous price actions in the process. As the price closes above 108.50 with a daily candle today, further bullish pressure towards 110.50 is expected before it continues to push lower towards 105.00 area in the coming days. As the price remains below 110.50 with a daily close, the bearish bias is expected to continue further.

SUPPORT: 105.50, 108.50

RESISTANCE: 110.50, 111.50, 112.00

BIAS: BEARISH

MOMENTUM: VOLATILE