USD/JPY has been quite impulsive amid the bearish pressure recently which pushed the price towards 104.50 support area from where strong bullish pressure pushed the price above 108.50. After the recent rate hike in the US, employment reports were not quite as expected which enabled the US currency to lose ground against JPY.

Ahead of FED Chairman Powell's speech on Thursday this week, FED's rate setting policy committee member Bostic recently commented on the monetary policy agenda for 2019. Citing Bostic, the rapid growth of US economy in 2018 encouraged the central bank to raise rates four times in a year which made certain businesses lose their confidence. If the FED continues to increase interest rate at the same pace as in 2018, it would leave a fallout on the domestic economy. Though Bostic admitted that the FED is going to lift interest rates at least once in 2019. It will have its great impact on the overall economic growth this year. Recently, ISM Non-Manufacturing PMI report was published with a decrease to 57.6 from the previous figure of 60.7 which was expected to be at 59.6. The worse economic result did not quite affect the USD gains over JPY but put the market into certain indecision ahead of FOMC Meeting Minutes and FED Chairman Powell's speech this week.

On the other hand, JPY has been quite hurt by the economic reports this week which lead to certain gains on the USD side. Recently Japan's Monetary Base report was published with a decrease to 4.8% from the previous value of 6.1% which was expected to be at 5.8%. Today Japan's Consumer Confidence also decreased to 42.7 from the previous figure of 42.9 which was expected to be at 42.8. Ahead of a series of economic reports this week, including Average Cash Earnings and Current Account report which are expected to show higher readings, JPY may lose further grounds against USD.

Meanwhile, market sentiment on USD is being indecisive but optimistic. Despite some recent downbeat data from the US, USD is currently in a better shape than JPY. After the holidays JPY started the year with waning momentum and dovish reports which might lead to certain weakness for the currency against USD in the coming days.

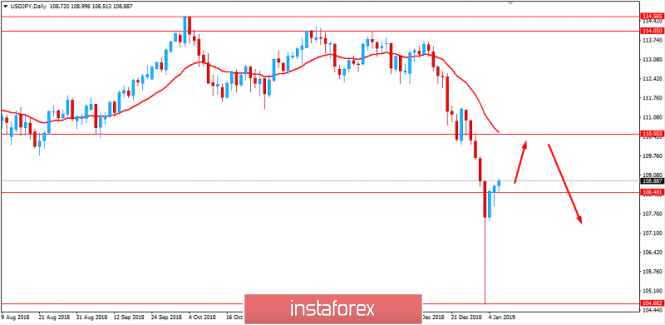

Now let us look at the technical view. The price is currently residing above 108.50 with a daily close which is expected to reach 110.50 resistance area in the coming days from where if any bullish rejection is observed, the price is expected to push lower towards 104.50-105.00 support area in the future. The price is currently residing quite far from the dynamic level of 20 EMA which indicates a retracement before continuing with the bearish trend in the future. As the price remains below 110.50 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 104.50, 105.00, 108.50

RESISTANCE: 110.50, 114.50, 115.00

BIAS: BEARISH

MOMENTUM: VOLATILE