GBP/USD recently rejected off the 1.30 price area amid strong bearish impulsive momentum. The pair is expected to sustain bearish pressure with a target towards 1.2700-50 support area. Only 2 months are left before the UK exits from the European Union. However, no proper deal which also sets out trade relations with the EU has been finalized yet. Meanwhile, the british lawmakers are discussing the alternative Brexit deal suggested by Theresa May.

Last week, the British Parliament rejected the Brexit divorce deal proposed by Prime Minister Theresa May. Now she has been searching ways to get the deal through the parliament, though without any success. The EU economy exceeds the UK economy six times. So the EU authorities want to have an orderly Brexit and do not want to struggle again with London, deepening a political crisis over Brexit. The political conditions in the UK are currently working as one of the factors, affecting GBP growth. Economic reports are another reason. Today UK Average Cash Earnings report is going to be published which is expected to be unchanged at 3.3%, Public Sector Net Borrowings are expected to have a positive change with a decrease to 1.1B from the previous figure of 6.3B, Unemployment Rate is expected to be unchanged at 4.1%, and Claimant Count Change is expected to have a positive result with a decrease to 20.1k from the previous figure of 21.9k.

On the other hand, this week is expected to be quite slow for USD as the economic calendar contains no economic reports fronm the US to encourage USD gain. Besides, upcoming economic reports are also expected to have bearish readings. Today, Existing Homes Sales report is going to be published which is expected to decrease to 5.27M from the previous figure of 5.32M. Next week, CB Consumer Confidence index and Federal Funds Rate report are due in the US, but they are of little importance for USD. So until next week, the US currency is expected to trade steadily against GBP. Despite the government shutdown for over 29 days, USD gains indicate its strength amid GBP weakness.

Meanhwile, GBP is propped up by optimistic expectations for the upcoming economic reports from the US. Nevertheless, the market is biased towards USD amid political tensions in the UK.

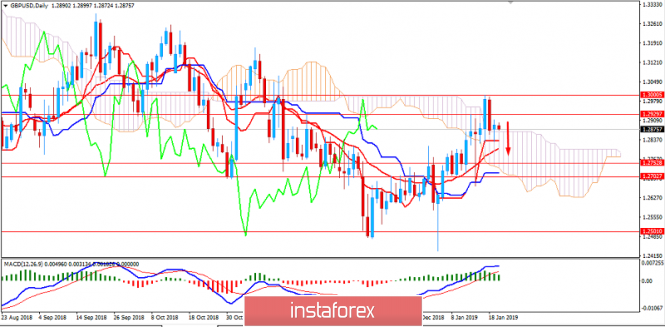

Now let us look at the technical view. The price is currently holding below 1.2900 area after certain indecision yesterday. Amid impulsive bearish momentum after rejecting off the 1.30 area recently, the pair is expected to retain bearish pressure towards 1.2700-50 support area in the coming days. As the price remains below 1.30 area with a daily close, the pair is set to trade with the bearish bias.

SUPPORT: 1.2500, 1.2700-50, 1.2850

RESISTANCE: 1.2930, 1.30

BIAS: BEARISH

MOMENTUM: VOLATILE