GBPUSD is currently quite impulsive with the bearish momentum after rejecting off the 1.2750 area with a daily close recently. Ahead of NFP with optimistic expectations and interest rate hike recently, USD is expected to gain further momentum over GBP while UK struggles with the BREXIT issues in the coming weeks.

Recently GBP Housing Equity Withdrawal report was published with decrease to -8.5B from the previous figure of -6.4B which was expected to increase to -6.0B. Despite the positive Manufacturing PMI report published today with increase to 54.2 from the previous figure of 53.6, GBP is struggling to maintain the bullish momentum which does indicate the strength of USD in the process. Moreover, tomorrow EURO M3 Money Supply report is going to be published which is expected to decrease to 3.8% from the previous value of 3.9% and Private Loans is expected to increase to 3.3% from the previous value of 3.2%.

On the other hand, ahead of NFP this week USD managed to gain impulsive momentum over GBP which might lead to further bearish pressure in the coming days. Today US Final Manufacturing PMI report is going to be published which is expected to be unchanged at 53.9 and tomorrow ISM Manufacturing PMI report is going to be published which is expected to decrease to 57.7 from the previous figure of 59.3. On Friday, Average Hourly Earnings report is expected to show increase to 0.3% from the previous value of 0.2%, Non-Farm Employment Change expected to increase to 178k from the previous figure of 155k and Unemployment Rate is expected to be unchanged at 3.7%.

As of the current scenario, USD is expected to dominate GBP further in the coming days as UK continues to struggle with the BREXIT and worse economic reports whereas positive economic results on USD is expected to lead to further gains with greater sustainability of the bearish momentum in the future.

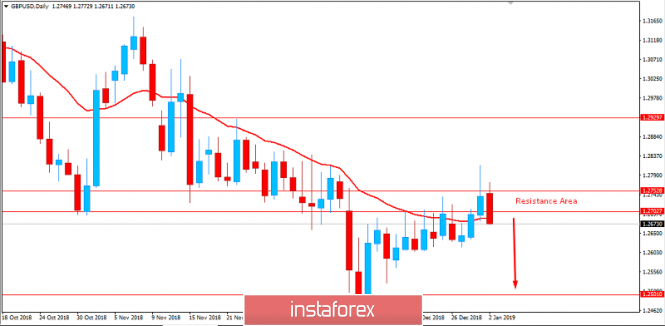

Now let us look at the technical view. The price is currently residing below 1.2700 area with a daily close as well as below the dynamic level of 20 EMA. A daily close below 1.2700 area is expected to lead to further bearish momentum in the pair with target towards 1.2500-50 support area in the coming days. As the price remains below 1.2750 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.2500-50, 126.50

RESISTANCE: 1.2700-50, 1.2850

BIAS: BEARISH

MOMENTUM: VOLATILE