USD/CHF recently pushed higher off the 0.9850-0.9920 support area which might to sustain bullish pressure in the coming days. USD has been struggling for gains amid the recent downbeat economic reports and fundamentals. However, USD managed to gain certain momentum over CHF which indicates CHF weakness.

This week CHF has been propped up by the economic reports but did not manage to sustain the bearish momentum over USD. Recently Switzerland's Unemployment Rate report was published with positive outcome of decrease to 2.4% which was expected to be unchanged at 2.5%. Interestingly, this did not quite help CHF to sustain the bearish momentum it had over USD earlier. Today the Swiss National Bank is going to post a Libor Rate report which is expected to be unchanged at -0.75%. Besides, SNB Monetary Policy Assessment is expected to be quite neutral that will hardly encourage CHF gains.

On the USD front, traders have no doubts that the Federal Reserve is going to make a pause in monetary tightening in 2019. So, the softer rhetoric of the US regulator dented the rally of USD. Moreover, President Trump thinks that a fast pace of rate hikes would be a big mistake for the future economic growth for the country. Recently US CPI report was published with a decrease to 0.0% from the previous value of 0.3% that spoilt investor sentiment on USD. Today US Import Prices report is going to be published which is expected to decrease to -1.0% from the previous value of -0.5% and Unemployment Claims is expected to decrease to 226k from the previous value of 231k. Retail Sales report is due tomorrow which is also expected to slow down to 0.2% from the previous value of 0.7%.

Meanwhile, the pair is set to trade with higher volatility today due to market-moving reports and events in Switzerland, which could lead to certain gains on the CHF side. Though USD has been struggling to gain momentum recently, any positive news on the Fed's intentions to continue monetary tightening can lead to impulsive gains in the future.

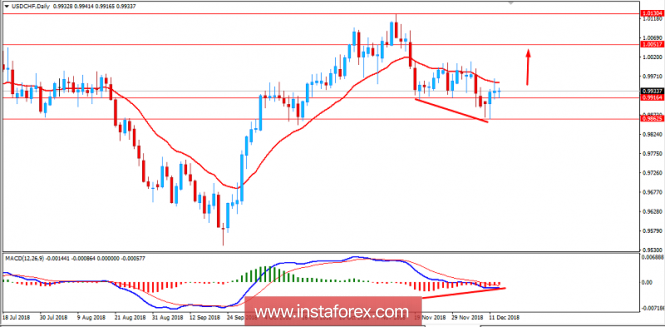

Now let us look at the technical view. The price is tarding higher, having Bullish Divergence formed recently which is expected to lead to further bullish pressure if it manages to break above dynamic level of 20 EMA resistance with a daily close. As the price holds above 1.00 area with a daily close, further bullish pressure is expected in this pair with a target towards 1.0130 resistance area in the coming days.

SUPPORT: 0.9850, 0.9920

RESISTANCE: 1.0050, 1.0130

BIAS: BULLISH

MOMENTUM: VOLATILE