AUD/JPY managed to push higher quite impulsively after impulsive decline from 84.00 earlier. Amid upbeat economic reports from Australia and optimistic expectations for the economy, AUD gain momentum against JPY.

The strong counter-move of AUD against JPY is assumed because of upbeat economic reports from Australia. On the other hand, JPY is struggling. This week Australia's Home Loans report was published with an increase to 2.2% from the previous negative value of -1.0% which was expected to be at -0.5%, HPI decreased to decreased to -1.5% as expected from the previous value of -0.7%, NAB Business Confidence decreased to 3 from the previous figure of 5, and Westpac Consumer Sentiment also decreased to 0.1% from the previous value of 2.8%. Today MI Inflation Expectation report was published with an increase to 4.0% from the previous value of 3.6% and RBA Bulletin was quite positive with the Merchant payment surcharges.

On the JPY side, recently Core Machine Orders report was published with a notable increase to 7.6% from the previous value of -18.3% which failed to meet the expected reading of 10.2% and PPI decreased to 2.3% from the previous value of 3.0% which was expected to be at 2.4%. Ahead of Tenkan Manufacturing and Non-Manufacturing Index reports with downbeat expectations, JPY is expected to lose further momentum against AUD.

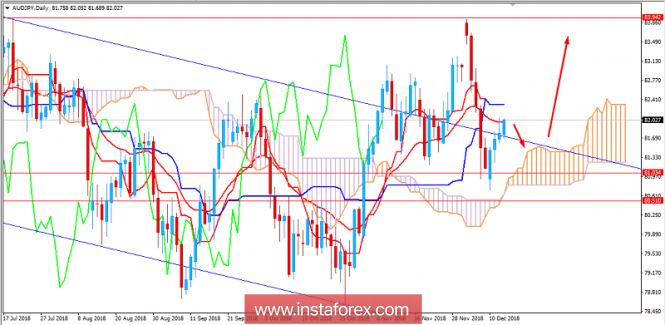

Now let us look at the technical view. The price has recently pushed above the downward sloping channel resistance. But the dynamic resistance from 20 EMA, Tenkan and Kijun line make it possible for the price to decline towards 81.50 area and Kumo Cloud support before climbing higher with a target towards 84.00 area in the coming days. As the price remains above 80.50 area with a daily close, the bullish bias is expected to continue further.

SUPPORT: 80.50, 81.00

RESISTANCE: 84.00

BIAS: BULLISH

MOMENTUM: VOLATILE