USD/CAD has been quite non-volatile with the recent bullish gains which is expected to lead the price towards 1.3450 resistance area in the coming days. Despite the softer rhetoric of the US Fed on monetary tightening and downbeat employment reports, USD managed to sustain the bullish momentum over CAD which is expected to turn a bit volatile in the coming days.

The risk of US recession in the next two years has risen to 40%. Besides, the Federal Reserve is going to rvise its agenda and ease a pace of rate hikes for 2019. Yesterday US Import Prices report was published with a decrease to -1.6% from the previous value of 0.5% which was expected to be at -1.0% and Unemployment Claims have been quite positive with a decrease to 206k from the previous figure of 233k which was expected to be at 226k. Today US Core Retail Sales is expected to decrease to 0.2% from the previous value of 0.7% and Retail Sales is expected to decrease to 0.1% from the previous value of 0.8%. Moreover, Industrial Production is expected to increase to 0.3% from the previous value of 0.1% and Business Inventories is also expected to increase to 0.6% from the previous value of 0.3%.

On the other hand, CAD has been quite positive amid Canada's employment reports which did not quite help the currency to gain impulsive counter momentum over USD. This week Canada also posted some reprts with mixed readings. As a result, CAD lost further momentum. Ahead of CPI, GDP and Retail Sales reports to be published next week, CAD is expected to struggle further in the process.

Meanwhile, USD is expected to sustain the bullish momentum further but with certain volatility due to bad fundamentals. Any positive news from Canada can easily support CAD.

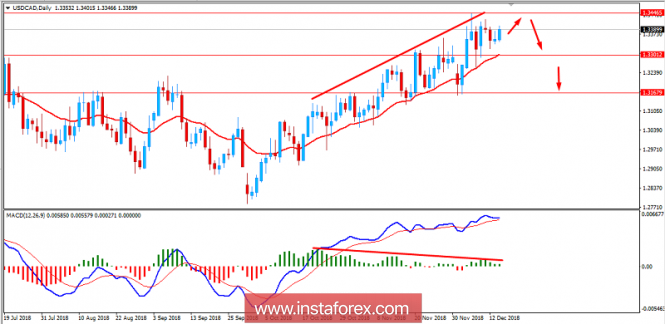

Now let us look at the technical view. The price has formed Bearish Divergence for a few weeks which is expected to lead to certain bearish pressure but after the price bounces off the 1.3450 resistance area with a daily close. Non-volatile trend but a strong pullback indicates the weakness of bulls. As the price remains below 1.3500 area with a daily close, there are certain probabilities of a bullish counter-move in the coming days.

SUPPORT: 1.3150, 1.3300

RESISTANCE: 1.3450, 1.3500

BIAS: BULLISH

MOMENTUM: VOLATILE