EUR/USD has been quite volatile with the recent bullish momentum after bouncing off the 1.1300 support area with a daily close. USD lost ground in light of the worse-than-expected NFP report on Friday. On the other hand, EUR is trading unchanged amid recently published economic reports.

EUR has been affected by Italy's budget deficit issue for 2019 which is still under consideration. Moreover, the eurozone is still under pressure amid lackluster economic growth and inflation pressure which might lead to a rate hike in the coming months. Today German Trade Balance report was published with a decrease to 17.3B from the previous figure of 17.7B, but performed better than the forecast of 17.2B, Italian Industrial Production increased to 0.1% from the previous value of -0.1% which was expected to decrease to -0.4%, and Sentix Investor Confidence decreased significantly to -0.3% from the previous value of 8.8% which was expected to be at 8.4%. Additionally, this week the economic calendar contains important economic reports and events to influence EUR, including the ECB policy meeting and Press Conference. Besides, EURO investors are also keeping an eye on the BREXIT deal developments which is expected to lead to certain shift in the market for the EURO in the coming days.

On the USD side, the NFP reports revealed quite mixed readings on Friday, thus knocking the US currency down. Recently Average Hourly Earnings report was published with a slight increase to 0.2% from the previous value of 0.1% which failed to meet the expectation of 0.3%, Non-Farm Employment Change decreased to 155k from the previous figure of 237k which was expected to be at 198k, and Unemployment Rate remained unchanged as expected at 3.7%. Today US JOLTS Job Opening report is going to be published which is expected to increase to 7.22M from the previous figure of 7.01M. Ahead of a probable rate hike this month, waning momentum of the US currency may lead to more indecision and volatility in the market.

Meantime, USD paused for breath whereas EUR is taking advantage of USD weakness and winning favor with investors. Though EUR/USD is likely to trade with higher volatility this week, EUR gains are expected to be short-lived. USD is expected to regain its momentum in case of further positive economic data and a rate hike at the Fed policy meeting.

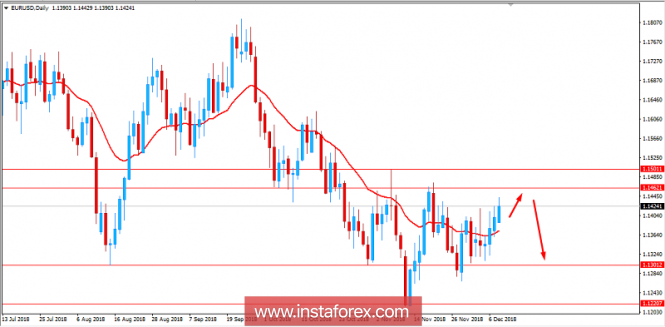

Now let us look at the technical view. The price is currently pushing towards the resistance area of 1.1500 from where it is expected to reject and lead the price lower, following bearish trend. As the price remains below 1.1500 area with a daily close, the bearish bias is expected to continue further with a target towards 1.1150-1.1200 support area in the future.

SUPPORT: 1.1150, 1.1200, 1.1300

RESISTANCE: 1.1450, 1.1500

BIAS: BEARISH

MOMENTUM: VOLATILE