USD/CHF has been quite corrective and volatile at the edge of 0.9980-1.0050 area from where the price is expected to move deeper. USD has been the dominant currency in the pair while CHF is struggling for gains amid disappointing economic data.

Despite the positive economic reports today, USD failed to sustain the bullish momentum that indicates certain weakness against CHF. Today US Retail Sales report was published with an increase to 0.8% from the previous value of -0.1% which was expected to be at 0.6%, Core Retail Sales also increased to 0.7% from the previous value of -0.1% which was expected to be at 0.5%, and Import Prices also showed an increase to 0.5% from the previous value of 0.2% which was expected to decrease to 0.1%. Moreover, FED Chairman Powell is going to speak today about the upcoming interest rate and monetary policy decisions. His remarks are likely to contain the hawkish rhetoric on the December interest rate hike to 2.50%.

On the CHF side, this week PPI report was published with an increase to 0.2% from the previous value of -0.2% which was expected to be at 0.1%. The positive economic result led to certain gains against USD which surprisingly is still being sustained.

Meanwhile, US economic conditions are healthy, which is mirrored in upbeat employment reports along with other high impact economic results as well. So, Fed has enough evidence that the US economy can withstand monetary tightening. On the other hand, rate hikes are assumed as the the factor holding back economic growth. CHF has been quite positive with the economic report recently but in comparison it is not sufficient to have a strong counter with this momentum against USD. To sum up, despite current corrective volatility and pullbacks, USD is expected to regain its momentum to extend a rally.

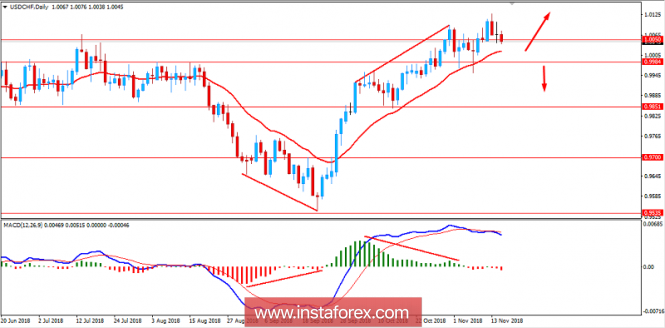

Now let us look at the technical view. The price has been quite non-volatile with the bullish momentum which was supported consistently by the dynamic level of 20 EMA. Despite having Bearish Divergence in the process, the price did not quite push lower with expected momentum. As the price remains above 0.9980 area with a daily close, the bullish pressure is expected to continue whereas a daily close below the area is expected to lead to certain counter in the process.

SUPPORT: 0.9980, 1.0050

RESISTANCE: 1.0100, 1.0150

BIAS: BULLISH

MOMENTUM: NON-VOLATILE