NZD/USD has been non-volatile and quite impulsive with recent bullish gains which has lead the price towards 0.6850 area. Despite the disapponting economic results, NZD managed to gain sustainable momentum over USD which is expected to be countered in the coming days.

Recently New Zealand FPI report was published with a decrease to -0.6% from the previous value of -0.1% which did not have the impact on the NZD buyers. Thus, the bulls are intruding with greater impulsiveness throughout the week. Today Business NZ Manufacturing Index report was published with an increase to 53.5 from the previous figure of 51.9 which had the opposite response from the market that made NZD lose some grounds currently.

On the USD side, recently CPI report was published with an increase to 0.3% as expected from the previous value of 0.1% and Retail Sales also showed a significant increase to 0.8% from the previous value of -0.1% which was expected to be at 0.6%. Overall, USD has been showing strong performance throughout the week thanks to the upbeat economic reports which indicates certain gains on the USD side in the coming days. Moreover, recently FED Chairman Powell spoke about the achieving the goal of maximum employment and an inflation target of 2% which encouraged further growth of USD. Today US Capacity Utilization Rate report is going to be published which is expected to have a slight increase to 78.3% from the previous value of 78.1% and Industrial Production is expected to decrease to 0.2% from the previous value of 0.3%.

Meanwhile, though NZD has been going quite strong against USD earlier, USD is expected to gain good momentum over NZD in the coming days. Until NZD comes up with better economic reports to back up its gains so far, USD maintains momentum for a while.

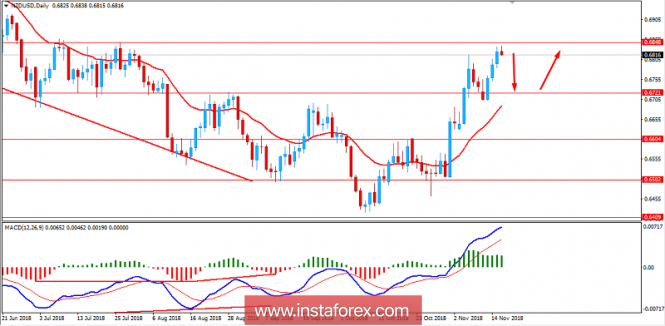

Now let us look at the technical view. The price is currently quite bearish below 0.6850 area while forming certain Bearish Divergence in the process. Currently the price is expected to push lower towards 0.6720 support area where the dynamic level of 20 EMA resides. As the price remains below 0.6850 area, there are certain chances of bearish pressure in the coming days with target towards 0.6720 area from where continuation of the bullish trend is expected in the future.

SUPPORT: 0.6600, 0.6720

RESISTANCE: 0.6850, 0.70

BIAS: BULLISH

MOMENTUM: NON-VOLATILE