GBP/USD has been quite impulsive with the bullish gains recently. The price is trading above 1.3050 with a daily close. Ahead of the high impact economic reports to be published this week, GBP is quite stronger compared to USD that might encourage further bullish momentum in the future.

GBP gained impulsive momentum over USD last week as the Bank of England left the official rate at 0.75%. On the other hand, some economic reports revealed lackluster results. Recently UK Services PMI report was published with a decrease to 52.2 from the previous figure of 53.9 which was expected to be at 53.4. Nevertheless, GBP managed to sustain the bullish momentum at the daily close which indicates weakness of USD. On Friday this week, GDP report is going to be published which is expected to increase to 0.1% from the previous value of 0.0%, Manufacturing Production is likely to ncrease to 0.1% from the previous value of -0.2%, Prelim GDP could have increased to 0.6% from the previous value of 0.4%, and Prelim Business Investment is also expected to increase to 0.0% from the previous value of -0.7%.

On the other hand, US Average Hourly Earnings report was published with a decrease to 0.2% as expected from the previous value of 0.3%, Non-Farm Employment Change increased to 250k from the previous figure of 118k which was expected to be at 194k, and Unemployment Rate remained unchanged at 3.7% as expected. Additionally, this week ISM Non-Manufacturing PMI was published with a decrease to 60.3 from the previous figure of 61.6, better-than-eexpected decrease to 59.3. Today investors are braced for a turbulent day for USD amid the midterm congressional election. Voters will elect all 435 members to the US House of Representatives and 34 members to the Senate. Ahead of the policy update, which will be announced on Thursday which is expected to be unchanged at 2.25%, USD is expected to be quite vulnerable to any surprises along the way.

Meanwhile, GBP is quite optimistic with the upcoming high impact economic reports. USD has chances to gain momentum in case of positive developments. As USD is struggling against GBP currently, the pair is likely to trade with the bullish bias amid higher volatility.

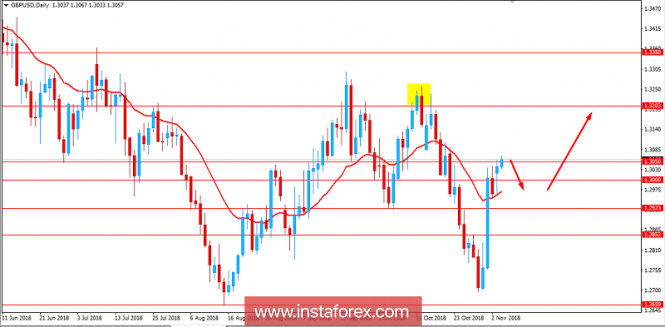

Now let us look at the technical view. The price is currently residing above 1.3050 area but with weaker-than-expected impulsive momentum to sustain the impulsive pressure further. Though the bias is bullish, certain bearish pressure leading to correction and retrace is expected in the coming days before the price starts to push higher with a target towards 1.3200 and later towards 1.3350 area. As the price remains above 1.2950 area, the pair is set to extend the bullish bias.

SUPPORT: 1.2850, 1.2950, 1.3050

RESISTANCE: 1.3200, 1.3350

BIAS: BULLISH

MOMENTUM: IMPULSIVE but VOLATILE