World markets are frozen in anticipation of the results of mid-term elections to the US Congress, as the results may significantly affect the prospects for the dollar. The most likely scenario is the loss of Republican control over the lower house and maintaining the minimum advantage in the Senate, only such a result will provide relative calm in the markets, both other options can lead to strong shocks.

If the Republicans succeed in retaining the majority in both chambers, it will mean the likelihood of another reform package, the return of Trump's harshness in trade negotiations and a generally stronger dollar. If the Democrats win back both chambers, then the dollar against the euro can rapidly fall below 1.13, and its prospects will be very weak. First of all, it is about the fate of the national debt ceiling, the agreement on which is valid until March 1, the victory of the Democrats with a high probability will lead to the infusion into the banking system from 200 to 350 billion dollars because of the reduction by the Treasury of its balance in the Fed.

Another important factor is that the growth of the labor market has ceased to support inflation expectations. Growth in average wages to a maximum rate over 10 years does not affect inflation, yields on 5-year bonds Tips after a short rebound in early October are falling again and almost reached annual lows, which indicates a high probability of seeing a slowdown in consumer inflation in the coming months.

The dollar, in fact, has only one way to maintain an uptrend - Republican control over both chambers. Both other scenarios with varying degrees of intensity will contribute to its weakening.

Eurozone

The euro has no direction and continues to trade in a narrow range in anticipation of the results of elections in the United States.

Investor confidence indicator Sentix fell in November to 8.8p, which turned out to be a two-year minimum, the eurozone continues to be in uncertainty about the plans of the ECB. The bank cannot fully control the size of its balance, as previously issued loans under T-LTRO may be repaid by previously established schedules due to their refinancing by commercial banks, the ECB is not satisfied with out-of-balance reduction, and it is not by chance that rumors about a new T-LTRO round appear. The ECB may decide on measures to counter the balance reduction "not on schedule", since the strengthening of the euro amid slowing business activity may adversely affect the state of the eurozone economy.

Today, Markit will present PMI data in November, expectations are neutral.

EURUSD is limited to the trading range of 1.1350 ... 1.1450, exit in any direction is possible according to the results of elections in the United States, if the results are generally in line with forecasts, the euro will continue trading in the range.

Great Britain

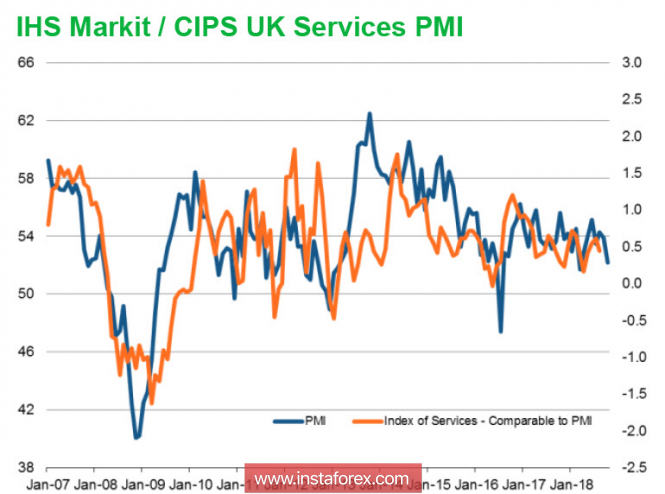

Despite the fact that the pound is making vigorous growth attempts due to rumors of an early agreement on Brexit, the state of the British economy looks increasingly alarming. Business growth in the services sector slowed to 52.2p, which is the minimum since March, new jobs have been created at the lowest rates since July 2016, the level of positive sentiment in the year perspective is also the lowest in more than 26 months.

And, nevertheless, the pound bulls look more than confident - the reason is that the third season of the Brexit series is approaching a happy end. Last week, the Times surprised markets with a statement that British banks could be allowed to stay in European markets after the "divorce", on Sunday there was evidence that May managed to agree on UK membership in the Customs Union that the deal is actually agreed and the matter is only in the formalities.

Markets expect the deal to be finalized by November 21, Brexit Minister Dominic Raab announced this date. If the rumors are confirmed, the pound will be able to sharply strengthen against the background of revising expectations for the Bank of England rate.

GBPUSD with a high probability will continue to grow on Tuesday, the nearest targets are 1.3115 and 1.3210, but if the deal is announced officially, then a gap to 1.35 and higher is possible.

The material has been provided by InstaForex Company - www.instaforex.com