At the end of the month, the Asian stock market is trying to get out of the 20-month lows, taking clues from Wall Street, where indexes have gained 1.4-1.8%. Chinese Shanghai Composite is growing 1.2% and Japanese Nikkei225 gaining 2.2%.

The PMI index for the Chinese industry in October fell to 50.2 from 50.8 in September, stronger than the forecast drop to 50.6. The market, however, hopes that fears about slowing China will be dispelled by the Beijing authorities announcing support for the economy.

In the foreign exchange market, the USD maintained its strength, but the changes are generally not large. EUR / USD is holding on to 1.1340 and GBP / USD has stopped before 1.27.

AUD went down after worse than expected CPI reading from Australia. In the third quarter, the price increase amounted to 0.4% q /q, by 0.1 percentage point below consensus. This is the eighth consecutive year when CPI falls below forecasts. AUD / USD bounced from the daily lows at 0.7070 up to 0.7095.

Crude oil prices bounce slightly after yesterday's breakdown to months lows. The market is currently paying more attention to the risk of increasing supply and declining demand under the influence of trade wars. WTI gains 0.5% and is up to 66.5 USD / b. There was no more reaction when the API report was published, which pointed to an increase in crude oil inventories by 5.7 million barrels last week. Estimates before today's DoE report show an increase of 3.1 million barrels.

On Wednesday, the 31st of October, the event calendar is very busy with important data releases. During the London session, Germany will post Retail Sales data, France will present Consumer Price Index data and the Eurozone will post Unemployment Rate and Consumer Price Index data. During the NY session, Canada will post GDP data and the US will present ADP Non-Farm Employment Change data, Chicago Purchasing Managers Index data and Crude Oil Inventories data. There are speeches scheduled for today from SNB Chairman Thomas Jordan, BOC Governor Stephen Poloz and BOC Senior Deputy Governor Carolyn Wilkins.

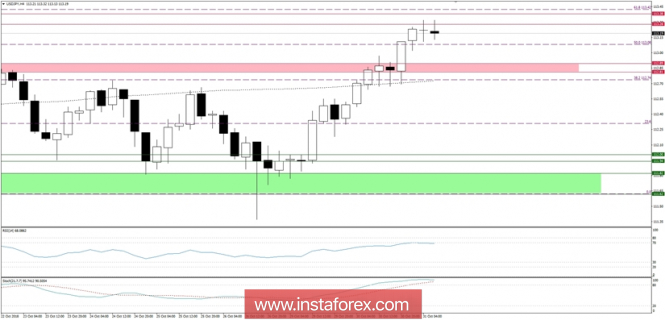

USD/JPY analysis for 31/10/2018:

USD / JPY goes to 113.20 and uses the Nikkei225 rally. On the negative side of the data for the yen, September industrial output from Japan dropped by 1.1% m / m (against -0.3% expected). The decision of the Bank of Japan went unnoticed - the bank kept the policy parameters unchanged, but it lowered the GDP forecast for the current fiscal year and the CPI forecast for the years 2018-2021.

Let's now take a look at the USD/JPY technical picture at the H4 time frame. The market has broken through the technical resistance at the level of 112.89 and made a new local high at the level of 113.30, just in the middle of the resistance zone located between the levels of 113.28 - 133.38. The next target for bulls is the 61% Fibo retracement of the previous swing down located at the level of 113.42, but the market conditions are now overbought, so a short-term pullback towards the level of 113.00 is now possible. Please notice the strong momentum supports the bullish bias.