AUD/USD has been quite volatile and corrective between the area 0.7050 to 0.7151 for a few weeks in a row after an impulsive non-volatile bearish trend. USD has been dominating AUD since the start of the year. USD is still able to maintain momentum despite some economic headwinds.

AUD has been struggling for gains amid the recent economic reports which fell short of expectations. As a result, the price growth is capped. Recently Australia's Building Approvals report was published with an increase to 3.3% from the previous value of -8.1% but it failed to meet the expectation of 3.8%. Today Australia's CPI report was published unchanged at 0.4% which was expected to increase to 0.5%, Trimmed Mean CPI report was published unchanged as expected at 0.4% and Private Sector Credit decreased to 0.4% as expected from the previous value of 0.5%. Ahead of the Trade Balance and Retail Sales reports which are due later this week, AUD may struggle a bit further in the process.

On the USD side, ahead of the NFP reports to be published on Friday, USD has been quite positive with the recent economic reports. Recently CB Consumer Confidence was published with an increase to 137.9 from the previous figure of 135.3 which was expected to be at 136.3. Today ADP Non-Farm Employment Change report is going to be published which is expected to decrease to 188k from the previous figure of 230k, Employment Cost Index is expected to increase to 0.7% from the previous value of 0.6%, Chicago PMI is expected to decrease to 60.1 from the previous figure of 60.4, and Crude Oil Inventories is also expected to decrease to 3.6M from the previous figure of 6.3M.

Meanwhile, Australia provided worse-than-expected economic reports even today which are certainly bearish for the Australian currency. On the other hand, USD found support from upbeat economic reports from the US. Analysts assume firm figures in the reports today. Moreover, the US Labor Department is due to release reports of major importance on Friday which are also expected to be quite mixed and indecisive. To sum up, USD has better chances to sustain gains against AUD.

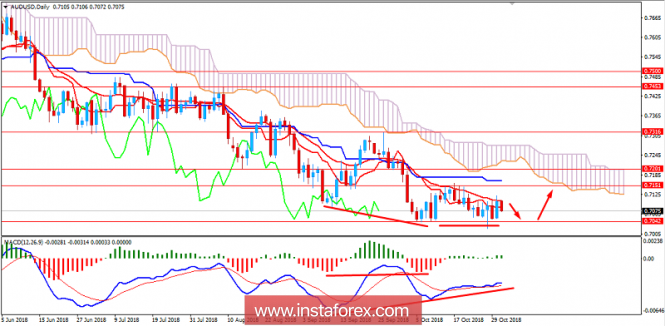

Now let us look at the technical view. The price is currently quite bearish despite the recent bullish impulsive pressure yesterday. After downbeat economic reports from Australia, USD managed to extend a rally. However, because of the recent formation of Bullish Divergence in price, there are certain chances of price climbing higher which may push the price above 0.7150 area towards 0.7300 area. As the price remains above 0.7050 area, there are certain chances of a strong bullish counter-move.

SUPPORT: 0.7050

RESISTANCE: 0.7150, 0.7300

BIAS: BEARISH

MOMENTUM: VOLATILE