Published on Sunday, economic statistics from China indicate a negative impact of the trade war between the US and China, which is already affecting the economy of the latter.

Presented September values of the index of business activity in the manufacturing sector (PMI) showed a decline greater than expected, to 50.8 points against 51.3 points in August and the forecast decline to 51.2 points. The manufacturing business index (PMI) from Caixin generally dropped to the level of 50.0 points, which separates economic growth from the beginning of its decline. It was assumed that the indicator would go down to 50.5 points from 50.6 points.

In the foreign exchange market, all major currencies reacted to depreciation against the US dollar, with the exception of the Canadian one, which is supported by the conclusion of a new trade agreement between the US, Mexico, and Canada and called the USMCA. Previously, a free trade agreement was called NAFTA.

But let's return to the market reaction to the Chinese data of economic statistics. The reason for this behavior is another increase in fear that the trade war between Washington and Beijing will lead to a noticeable slowdown in global economic growth, which will also have an impact on the economies of Europe and Asia. And even the US can be strongly influenced, despite the conviction of President D. Trump, that in this trade conflict, America will only benefit.

Given this state of affairs, we can assume that the local upward dynamics of the dollar may continue. And here, two factors play in his favor. This, as has been repeatedly mentioned earlier, the function of the safe-haven currency and the Fed's plans to further raise interest rates, which reinforces only the discrepancy in the attractiveness of the dollar relative to other major currencies. In addition, the positive for the dollar is the conclusion of the USMCA agreement, which allows the US to switch completely to the fight against Europe and China.

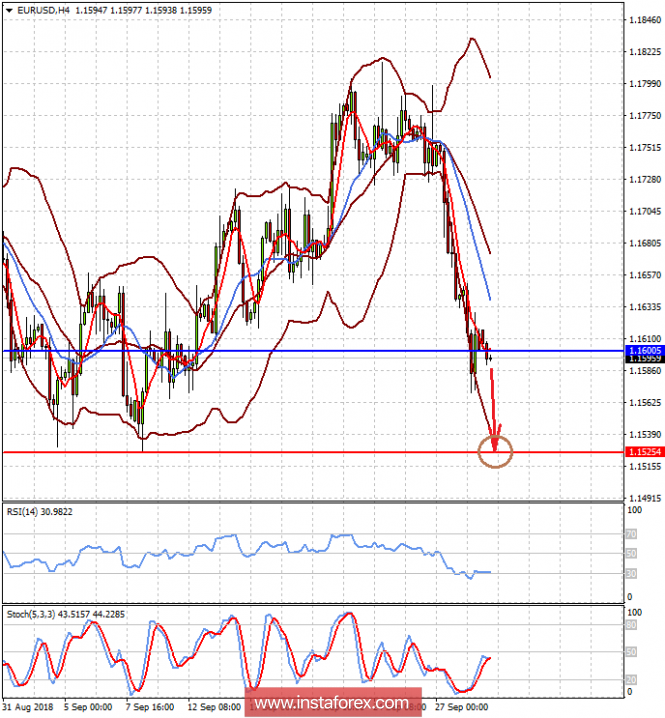

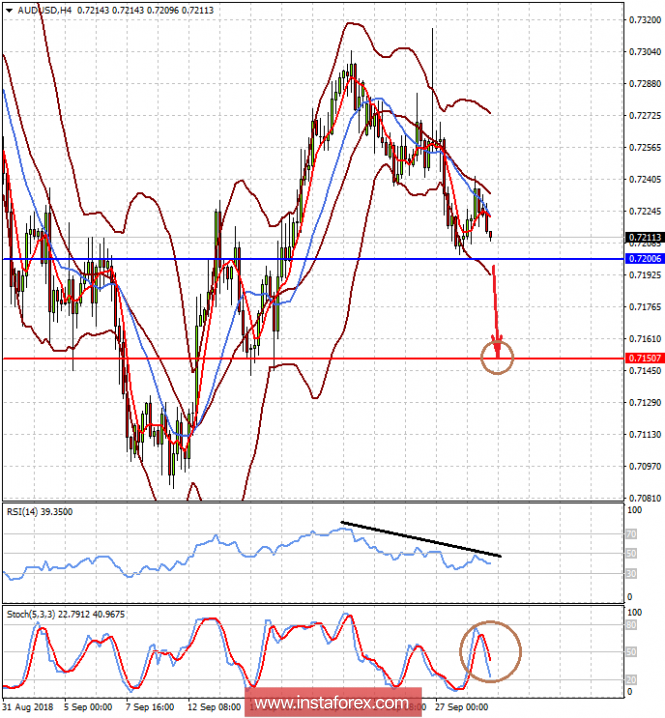

Forecast of the day:

The currency pair EUR / USD is trading near the level of 1.1600. The pair may continue the local decline to 1.1525 if it keeps below this mark, continuing as a whole to move in the outset.

The currency pair AUD / USD is trading above the level of 0.7200. Fears related to the Chinese economy will put pressure on the pair, since China is the main trading partner for Australia and its slowdown will negatively affect its growth. Given this, we can assume that the local decline in the pair will continue to 0.7150 if it falls below the mark of 0.7200.