USD / JPY pair

With negative economic data this morning added to the neutral background of the stock markets on Thursday and Friday, the Japanese yen is resolutely breaking through, adding more than 100 points over the last two sessions. We believe that without the participation of the Bank of Japan, which could secretly connect to the tariff war against the US, it is less likely to happen. If so, then we are waiting for at least the medium-term growth of the Japanese currency. However, it will not be difficult for the yen to grow because the US dollar also headed for a decisive strengthening.

The index of business activity of the largest manufacturers of Japan (Tankan Manufacturing Index) for the 3rd quarter fell from 21 to 19 against the expected growth of 22. The Tankan Non-Manufacturing Index fell to 22 from 24 against a downward forecast of 23. On the other hand, the final assessment for the business activity in the manufacturing sector PMI as 52.5 against 52.9 in August, as well as, in the preliminary assessment.

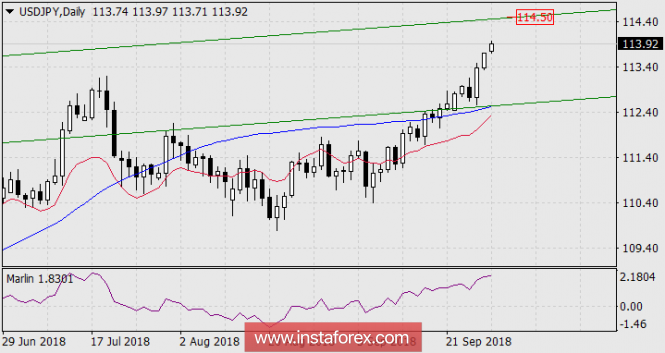

In the last review on the yen, we assumed that the MACD support line for H4 can be broken, but it stood and the price turn came from the line. The price came out of the upward price channel this morning. The immediate goal is the resistance of the trend line of the rising price channel at 114.50. Overcoming resistance will open a higher resistance target in the same way as the trend line (parallel) in the area of 116.42 (can be seen on the weekly chart).