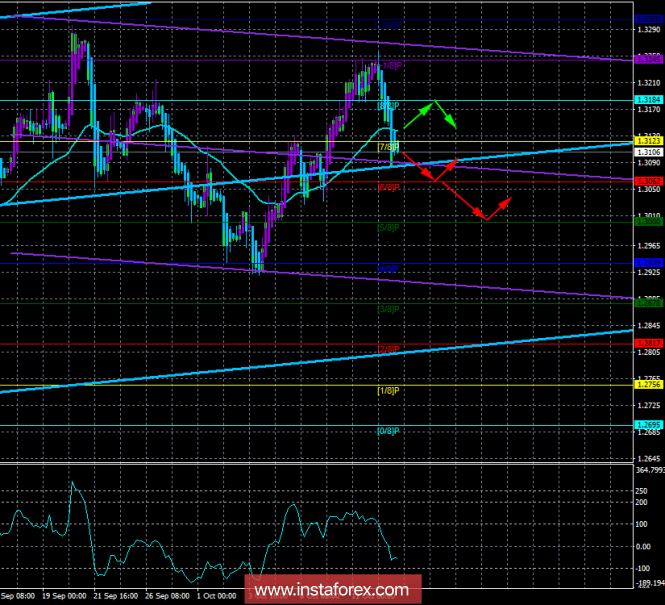

4-hour timeframe

Technical details:

The senior linear regression channel: direction - up.

The younger linear regression channel: direction - down.

Moving average (20; smoothed) - sideways.

CCI: -45.0798

The currency pair GBP / USD on October 12 and 15 has declined quite strongly. On the one hand, the technical price rebound from the Murray level "+1/8" is sufficient reason for the correction. Overcoming the MA has changed the upward trend in the pair to the downward one. On the other hand, questions remain on the fundamental component. Recently, we have often seen a picture when any rumors about the Brexit negotiations were accompanied by the growth of the British currency, although, as we have already written more than once, there was very little official information and the rumors were not confirmed by anything. However, this week, October 17, the EU summit will take place, during which the UK will again hold talks with Brussels on the most important issues on Brexit. This is, firstly, the border between Ireland and Northern Ireland, and secondly, the issue of trade after Brexit between the EU and London. Thus, this week, with a high degree of probability, we will receive official information, and now, the future pound sterling will depend on it for the near future. If the negotiations fail again, as was the last time, it will create pressure on the British currency. Leaving the EU without a "deal" will deal a severe blow to the British economy, everyone understands this. If the negotiations do end up with the signing of the relevant documents, this may support the pound sterling, but it is hardly strong.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The currency pair GBP / USD has overcome the moving. Thus, short positions with the target of 1.3062 are now relevant. A reversal of the Heikin Ashi indicator up will signal a possible resumption of an uptrend and a reduction in shorts.

Buy positions are recommended to open if the pair consolidates above the moving average line, which will mean a return to the upward trend with the first target of 1.3184. The weak report on US retail sales can support today pound.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanations for illustrations:

The senior linear regression channel is the blue lines of the unidirectional movement.

The junior linear channel is the purple lines of unidirectional movement.

CCI is the blue line in the indicator regression window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heikin Ashi is an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company - www.instaforex.com