USD/JPY has been quite impulsive with the recent bearish gains which lead the price to reside below 112.00 area currently. In light of recent downbeat economic reports from the US, JPY gained impulsive momentum in the pair which may continue further in the coming days.

USD has been struggling for gains amid worse-than-expected economic reports, including decrease in CPI to 0.2% from the previous value of 0.1%. Today US Retail Sales report was published unchanged at 0.1% which was expected to increase to 0.7% and Core Retail Sales decreased to -0.1% from the previous value of 0.2% which was expected to increase to 0.4%. This week, the economic calendar lacks macroeconomic reports from the US. Thus, certain setbacks may be observed on the USD side in the coming days.

On the JPY side, ahead of the Trade Balance and Bank of Japan's Governor Kuroda's speech, recent economic reports were not that remarkable to encourage further JPY gains. Today Japan's Revised Industrial Production report was published with a decrease to 0.2% which was expected to be unchanged at 0.7%.

Meanwhile, despite soft economic reports, JPY managed to gain and extend strength against USD. So, the current market sentiment may lead the price much lower in the coming days. If BOJ Governor Kuroda presents optimistic statement in his speech this week, further impulsive pressure on the bearish side can be observed in this pair.

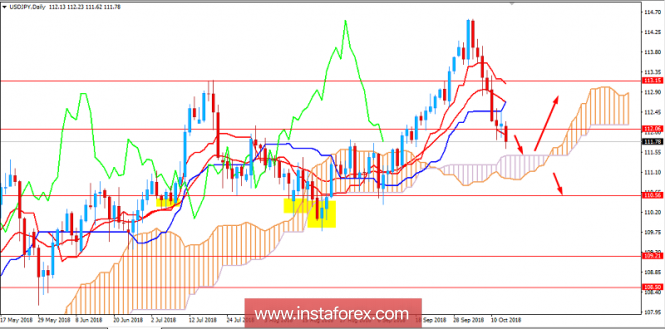

Now let us look at the technical view. The price has been made impressive bearish swings today after being quite indecisive with a daily close on Friday. Thanks to the recent indecisive daily candle, the price is expected to climb higher according to the long-term trend. As the price sustained the bearish pressure and managed to push lower, it is expected to sink deeper towards 110.50 support area in the coming days. On the other hand, the price having Kumo Cloud support as the dynamic level may cause the price to bounce higher with a target towards 113.00 as the current trend is bullish. As the price remains below 112.00 area, the bearish bias is expected to continue.

SUPPORT: 110.50, 108.50

RESISTANCE: 112.00, 113.00

BIAS: BEARISH

MOMENTUM: VOLATILE