EUR/JPY has been quite volatile after breaking below 129.50 with a daily close which is currently heading higher for a retesting the area again. JPY has been the dominant currency in the pair but recently, due to certain positive EURO economic outcomes, the market sentiment bias is getting indecisive which might lead to a certain change in the process.

Recently JPY All Industry Activity report was published with an increase to 0.5% from the previous value of -0.2% which was expected to be at 0.4% and BOJ Core CPI remained unchanged at 0.5%. Recently Bank of Japan warned Japan's Banks risk taking which hits 3 decades high in the April to September session which is expected to lead to ultra-easy monetary may overheat certain industries in the country. Though the banks are still quite stable but having higher risks which might lead to certain fluctuations may seriously affect the overall financial sector of the country. Today, Flash Manufacturing PMI report was published with an increase to 53.1 from the previous figure of 52.5 which was expected to be at 52.6. Ahead of the Tokyo Core CPI report to be published on Friday, further volatility may be observed as the expectation for the value is to remain unchanged at 1.0%.

On the other hand, the EURO is currently struggling with Italian Budget issue. The Budget Deficit of Italy was recently rejected by Europe Union as they claimed that it broke EU rules on Public Spending and asked Rome to submit another one by three weeks or face disciplinary actions. Today EURO French Flash Manufacturing PMI report is going to be published which is expected to slightly decrease to 52.4 from the previous figure of 52.5, French Flash Services PMI is expected to slightly decrease to 54.7 from the previous figure of 54.8, German Flash Manufacturing PMI is expected to decrease to 53.4 from the previous figure of 53.7 and German Flash Services PMI is also expected to decrease to 55.5 from the previous figure of 55.9. Additionally, EURO Flash Manufacturing PMI is expected to decrease to 53.0 from the previous figure of 53.2 and EURO Flash Services PMI is expected to decrease to 54.5 from the previous figure of 54.7.

As of the current scenario, the EURO is quite dovish with the upcoming economic reports whereas JPY has been quite hawkish. Though certain tension is being emerged in Eurozone for the Italy budget deficit issue but having a better result may lead the market to favor the EURO gains in the coming days or else JPY may lead the price much lower in the coming days.

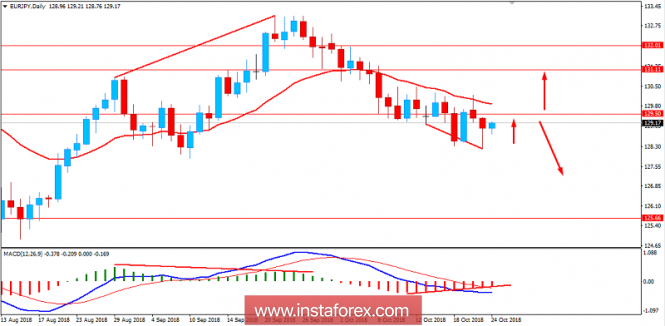

Now let us look at the technical view. The price has been quite impressive with the recent bullish gains recently which resulted to impulsive bearish rejection in the process. Though the price is residing below 129.50 area with a daily close, there are certain chances of bullish breakout above 129.50 and pushing the price higher towards 131.00 area. On the contrary, if the price rejects off the 129.50 again with a daily close, the bearish pressure is expected to continue to lead the price towards 125.50 area in the future.

SUPPORT: 125.50

RESISTANCE: 129.50, 131.00

BIAS: BEARISH

MOMENTUM: VOLATILE