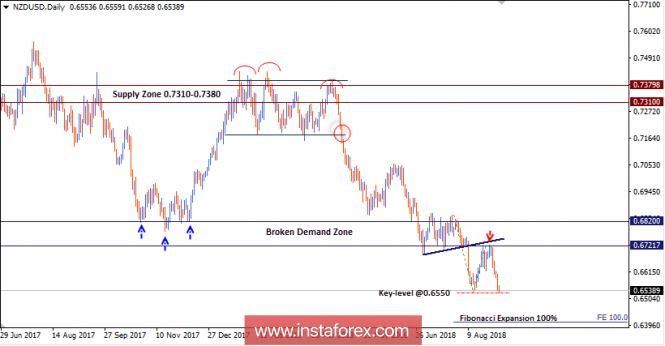

In April, bearish breakdown of 0.7220-0.7170 (lower limit of the consolidation range) allowed a quick decline towards 0.6700-0.6800 where narrow ranged consolidation range was established. On July 7, evident bullish rejection pushed the NZD/USD pair above 0.6820 temporarily. However, lack of bullish momentum made the bulls fail to maintain enough bullish momentum above 0.6700. On August 9, bearish breakout below the depicted consolidation range (0.6840-0.6700) was executed. This allowed the recent bearish decline to occur towards 0.6600-0.6570. The NZD/USD pair outlook turned to be bearish. Bearish targets are projected towards the price levels of 0.6520 and 0.6480. Recently, signs of bullish recovery were manifested around the previous weekly/monthly low around 0.6550. This allowed the recent bullish pullback towards 0.6700 to be demonstrated.Evident bearish rejection was demonstrated around 0.6700 (broken demand-zone and backside of the broken-trend) where the current bearish decline was initiated.Currently, the price level of 0.6550 stands as a prominent demand-level before further bearish decline can occur towards 0.6420.

Trade Recommendations: Risky traders can wait for bearish decline below 0.6550 (key-level). This offers a high-risk SELL position. Initial T/P should be placed around 0.6420 (Fibonacci Expansion 100%).

The material has been provided by InstaForex Company - www.instaforex.com