Weak data on the euro area and a good report on the growth of consumer confidence in the US supported the US dollar on Friday, keeping an upward trend behind it.

According to the report, the consumer price index in the euro area fell in August this year, being worse than economists' forecasts, which could lead to a revision of the policy of the European Central Bank regarding the further rate of interest rates. However, the current slight decrease in the level of inflation is not yet an excuse for unrest.

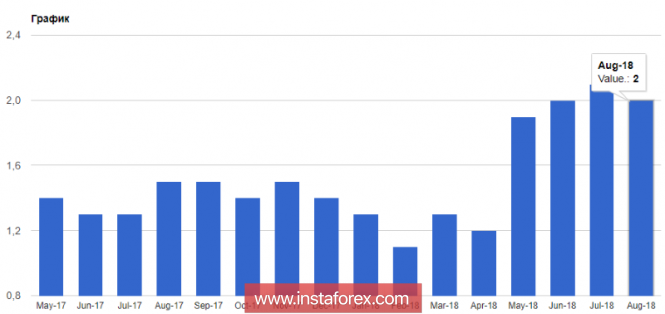

So, the annual consumer price index of the eurozone was 2.0% in August against 2.1% in July. Economists had expected inflation to remain unchanged.

The data in the second half of the day provided support to the US dollar.

The trust of households in the US in August 2018 increased. According to the report of the University of Michigan, the final index of consumer sentiment was 96.2 points against 95.3 points. Economists predicted the value of the index at 95.4 points.

As noted in the report, consumers are confident in their prospects in terms of income and employment, which allows us to count on further growth in the index.

Traders missed the information that the index of supply managers PMI Chicago in August this year fell.

According to the data, the index fell to 63.6 points against 65.5 points in July, while economists predicted that the index will be 63 points. Let me remind you that the index values above 50 indicate an increase in activity.

As for the technical picture of the EUR / USD pair, the pressure on the euro will continue. A breakthrough in support at 1.1590 will lead to a new wave of decline in risky assets with a test of lows of 1.1535 and 1.1490.

The Canadian dollar fell against the US dollar on Friday after it became known that the US and Canada did not reach a trade agreement.

As the Canadian foreign minister noted, Canada has not yet joined the NAFTA agreement. Freeland said that it requires a good agreement, not anyone since Canada primarily defends its national interests. The US trade representative called the negotiations with Canada constructive and noted progress. A new stage of negotiations will be held this Wednesday, September 5.

The material has been provided by InstaForex Company - www.instaforex.com