The European currency and the British pound rose against the US dollar, but it is still not possible to maintain the current growth rates. Pressure on the US dollar was formed on Monday in the afternoon, after the President of the United States Donald Trump criticized the Chairman of the Federal Reserve Jerome Powell.

It has long been clear that Trump does not share the policy of the Fed chairman, as it makes the US dollar less competitive. Let me remind you that in the near future the Fed plans to further tighten monetary policy, and a number of investors expect that the central bank may even double the rate this year to normalize the policy.

Trump also criticized China and the European Union, which, in his opinion, are engaged in the manipulation of their currencies. Most likely, it was about the fact that China constantly resorts to the policy of weakening the national currency, and the European Central Bank is in no hurry to start raising interest rates after the US, which leads to an imbalance and demand for the US dollar from a number of investors.

There are also rumors on Tuesday that in the near future the administration of US President Donald Trump may decide to impose new tariffs on goods from China, which will affect almost half of imports. Fees can be imposed, even despite the discontent of a number of large US companies, as well as a new phase of the US-China trade negotiations.

Despite all this, the short-term growth potential of the European currency and the British pound is under big questions. It is likely that the big players who are betting on further strengthening of the US dollar, such an upward movement is even necessary, which allowed to remove a number of stop orders of short-term sellers above large resistance levels and gain a new position for further downward movement.

As for the technical picture of the EURUSD pair, the upside potential is limited by the resistance of 1.1540, and only its breakthrough will allow us to expect further strengthening of risky assets, with an update of the highs of 1.1600 and 1.1660. In the event of a resumption of the euro decline, which seems to be a more likely scenario, support will be provided by levels 1.1460 and 1.1400.

The Australian dollar ignored the publication of the minutes of the last meeting of the Reserve Bank of Australia and only slightly strengthened against the US dollar.

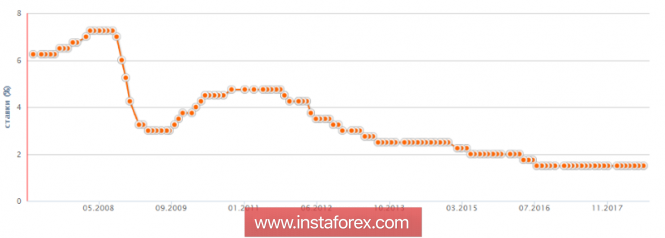

The RBA protocols indicated that the next change in interest rates is likely to be an increase, but currently there is no serious argument in favor of changes in interest rates in the short term, as the preservation of rates at the same level provides stability and confidence.

The RBA also believes that the current level of rates allows to achieve the target level of inflation, as the fall in electricity prices can have a negative long-term impact on the consumer price index in Australia.

The material has been provided by InstaForex Company - www.instaforex.com