News on the achievement of the free trade agreement (NAFTA) between the US and Mexico on Monday stirred up financial markets, raising the demand for risky assets, while exerting pressure on the US dollar.

The statement of D. Trump that the US agreed on terms of trade with Mexico within the framework of the updated free trade agreement (NAFTA), provided good support to the mood of investors in world markets. Bidders perceived this news as a possible forerunner of future agreements already between the States and Canada and, what's more, do not joke with China. Stock markets in Europe and the US closed in green, and the trading session in the PRC and in Asia as a whole also took place on a positive note.

On this wave, the demand for risky assets - shares of companies and commodity-raw assets - increased. But the US dollar has somewhat passed in relation to the major currencies, which can be explained by a decrease in the interest of market players in defensive assets. By the way, the yields of government bonds of the US Treasury have also grown. So, the profitability of the 10-year Treasury benchmark rose to 2.884% from 2.846%.

And here the question arises. And is it worth expecting further demand for risky assets and a local weakening of the dollar rate?

In our view, the agreement between the US and Mexico is positive, but it does not solve the main problem - the growth of risk for the world economy. And it is precisely in the trade relations between China and the States, an agreement between which has not been achieved. Therefore, in our opinion, if this most important agreement is not reached, then the markets will again fall into pessimism, and the rate of the American currency will be supported by the function of a currency-refuge.

Estimating the overall prospects for the dollar's movement on the market, we believe that the overall lateral dynamics in the market of currency pairs with the US dollar will continue in the near future, although, of course, speculators will try to sell it on any small positive.

Forecast of the day:

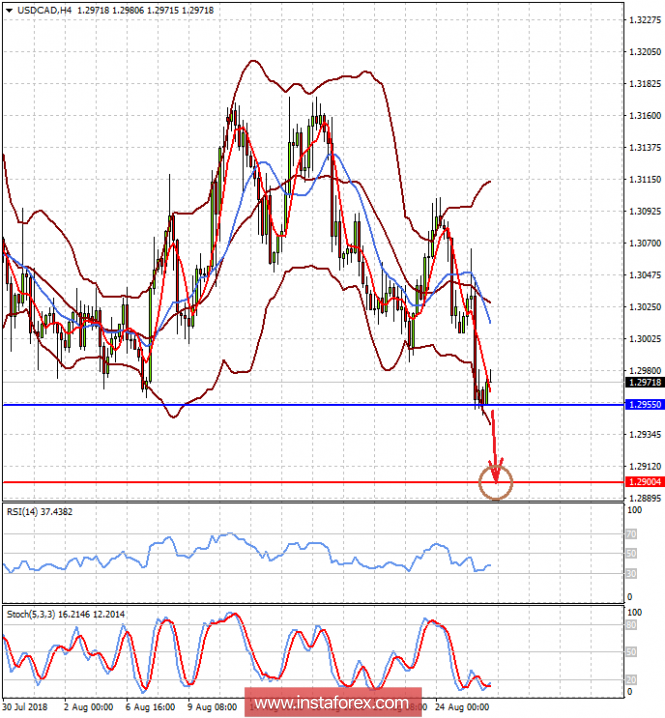

The pair USD / CAD is trading above the level of 1.2955. It has the potential of a local decline to 1.2900 after the crossing of this mark on the wave of rising crude oil prices, as well as the revived hopes that the US and Canada can agree on terms of mutual trade.

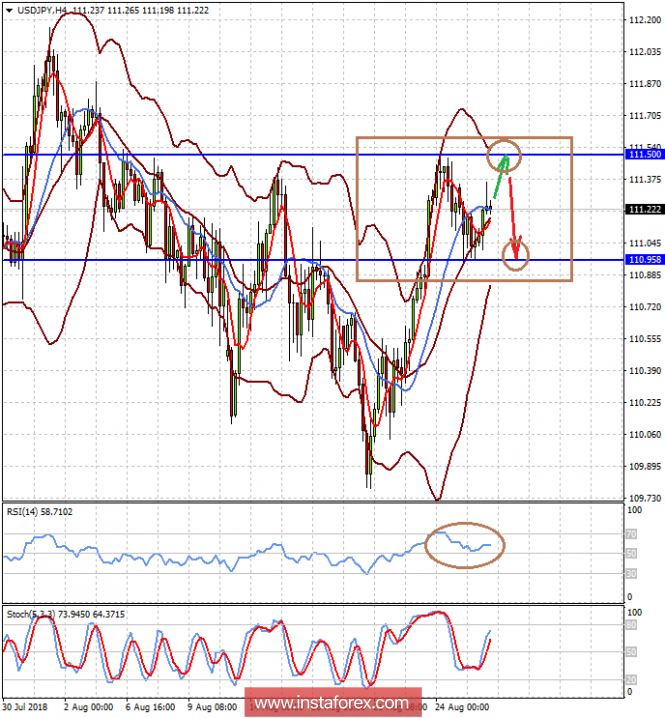

The pair USD / JPY is trading in the range of 110.95-111.50 against the backdrop of conflicting signals, which do not allow it to grow or fall. But the balance of the negative is still likely to prevail, so we consider it possible to sell the pair on growth, from about 111.50 to 110.95.