AUD/USD has been quite corrective and volatile between the range of 0.73 to 0.75 area for a few weeks now. AUD has been quite positive with the recent economic reports which helped the currency to gain momentum in the process while USD is struggling with recent economic reports and Trade War situations.

AUD has been quite mixed with the economic reports this week while the decrease in certain results proved much worst for the currency gains. This week, AUD Home Loans report was published with a decrease in negative value of -1.1% from the previous positive value of 1.0% which was expected to be at 0.1%. Ahead of the RBA Monetary Policy Statement on Friday, AUD is expected to be quite volatile with the upcoming gains in the process.

On the USD side, today PPI report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Core PPI is expected to decrease to 0.2% from the previous value of 0.3%, Unemployment Claims is expected to increase with negative impact to 220k from the previous figure of 218k and Final Wholesale Inventories is expected to be unchanged at 0.0%.

As of the current scenario, USD may lead the process if it manages to publish better than expected result for the upcoming high impact economic reports whereas AUD Monetary Policy is also expected to inject certain volatility in the market as well. To sum up, if USD reports are published better than expected further gains on the USD side is expected which is more likely for the current market sentiment and fundamentals.

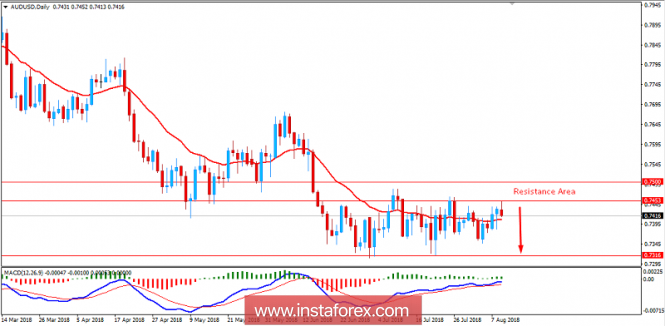

Now let us look at the technical view. The price is currently residing at the edge of 0.7450-0.7500 resistance area from where it is expected to push lower as of the recent bearish impulsive pressure being observed in the market currently. MACD having no divergence in the process against the momentum is expected to support the bearish pressure in the pair for the coming days. As the price remains below 0.75 with a daily close, the bearish bias is expected to continue further with a target towards the support area of 0.7300 area.

SUPPORT: 0.7300

RESISTANCE: 0.7450-0.7500

BIAS: BEARISH

MOMENTUM: VOLATILE