Inflationary pressure in the US is increasing. This conclusion can be drawn from the results of the publications of the past week. Indeed, there was a noticeable increase in consumer and mortgage lending in May while producer prices showed growth exceeding forecasts. The annual growth in consumer prices tightened 2.9% against 2.8% a month earlier in June. Meanwhile, the root inflation index rose from 2.2% to 2.3%. The rise in inflation expectations should lead to an increase in the likelihood of a fourth increase in the Fed rate this year. In any case, the CME futures reduced the likelihood that there will be no increase to 40%.

However, this impression is deceptive. The yield of the bonds high reached its maximum by May 15 which reflect the real inflation expectations of the business. Since then it has been trading lower for two months, it may instigate doubts about the steady growth of consumer demand.

Published on Friday, the consumer confidence index from the University of Michigan declined in July from 98.2p to 97.1p, which indicates an increase in consumer fears of economic prosperity in the near future.

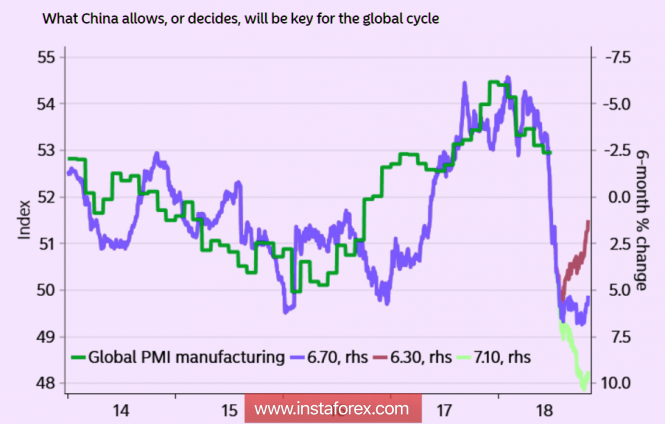

Regarding the fears, after the start of the active phase of the confrontation between China and the US, the yuan was devalued to 7.00 per dollar. Further escalation could bring the global slowdown phase closer, as a stronger dollar tightens financial conditions in emerging markets. Global PMI is a lagging indicator in relation to the yuan exchange rate, so further escalation of the conflict is fraught with unfolding a new wave of the crisis even before the Fed leaves the regime of soft monetary policy.

Published on Monday morning, the GDP data in the second quarter was better than expected, the economy grew by 6.8%. Industrial production grew by 6.7% and there is generally no fear of slowing down, which generally reduces tensions.

The long-awaited meeting between Putin and Trump can significantly increase volatility, given the ability of both leaders to make unexpected decisions. The American side is trying to lower the level of expectations, so as not to provoke a wave of disappointment in the markets, and there are no objective reasons to expect a breakthrough because the fundamental contradictions between Moscow and Washington are too strong.

The week will begin without a traditional swing. On Monday, in addition to the widely advertised meeting between Putin and Trump, a report on retail sales in June will be published, which is traditionally used as an indicator of consumer demand.

On Tuesday, Federal Reserve Chairman Powell will address the Congress before the Senate. In addition, a report on industrial production in June and a report of the Treasury on the movement of foreign capital will be published in May. A month ago, Russia became the troublemaker of peace, having cut its investments in US securities almost twice in April. This time attention will be focused on China since it was in May that the active phase of US pressure on tariffs began.

On Wednesday, another speech by Powell but this time in front of the House of Representatives will also be published in beige book FRS and dynamics on the construction sector for June.

Before the report in Congress, the Fed published a six-month report and Powell gave an extensive interview last week. The position of the regulator does not look too optimistic despite the strong labor market and economic growth. The Fed notes that inflation is maintained at a high level largely due to rising energy prices, and wage growth is not sure enough.

The dollar is losing momentum to growth, in anticipation of new data, the most likely scenario is trading in the range. The EUR/USD pair may rise to resistance 1.1734 / 42, by the end of the day the euro may fall on news from Helsinki. The pound looks a little less confident where the GBP/USD pair is bounded from above by the zone of 1.3278 / 88, a little more likely to decline by the end of the day to 1.3155 / 67.

The material has been provided by InstaForex Company - www.instaforex.com