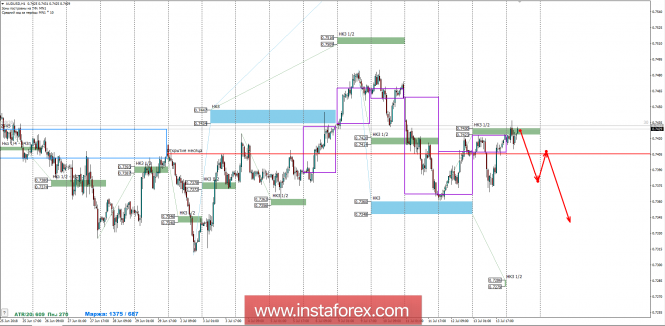

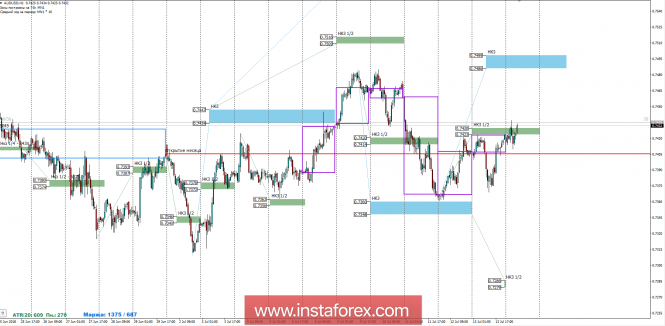

Last week, the implementation of the top-down model occurred. After the test of a weekly short-term fault of 0.7360-0.7340, there was an increase in demand and the formation of an absorption pattern. Today's test of the NCP 1/2 will prompt further priority.

Today, there is a test of the determining zone of resistance NCP 1/2 0.7430-0.7423. Depending on where the US session will be closed, trade decisions will be made this week. While the pair is trading below this zone, the downward movement remains a priority. Sales are best done after the formation of the pattern, as on Friday there was a daily absorption, which indicates a local ascending priority.

Favorable selling prices are within the limits of the NCP 1/2, however Friday absorption requires the formation of a reverse pattern for confirmation. This is also facilitated by the completion of the descending model and the weekly short-term fault test last week.

An alternative model will develop in the event that today's close of the American session occurs above the level of 0.7430. This will open the way for growth in the July high, which will allow purchases to become profitable. The main target will be located at weekly short-term fault of 0.7499-0.7486, which will make the ratio of risk to profit more than 1 to 3, and the probability of working out of the ascending model is 70%.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com