AUD/USD has been quite volatile and corrective recently while residing inside the range of 0.74 to 0.75 area with a daily close. Despite the positive economic reports today, AUD failed to gain momentum against USD which does indicate the dominance power of USD at the current market scenario.

Today AUD Employment Change report was published with a significant increase to 50.9k from the previous figure of 13.4k which was expected to be at 16.7k and Unemployment Rate was unchanged as expected at 5.4%. Additionally, NAB Quarterly Business Confidence report was published with a slight decrease to 7 from the previous figure of 8.

On the other hand, after the positive Retail Sales report this week, USD has been quite impulsive with the gains in the market. Today USD Philly Fed Manufacturing Index report is going to be published which is expected to increase to 21.6 from the previous figure of 19.9 and Unemployment Claims report is expected to increase to 220k from the previous figure of 214k. Moreover, today USD CB Leading Index report is going to be published which is expected to increase to 0.4% from the previous value of 0.2%, Natural Gas Storage is expected to increase to 58B from the previous figure of 51B and FOMC Member Quarles is going to speak today about the upcoming monetary policy and interest rate decisions.

As of the current scenario, AUD has been quite positive with the economic reports already published which did contribute for the certain gain on the bullish side today but could not sustain it. Moreover, USD forecasts are quite mixed which is expected to inject certain volatility in the market. Though AUD managed to provide better reports, USD is still on the dominance mood and expected to gain further momentum if it gets better support from the upcoming economic reports to be published.

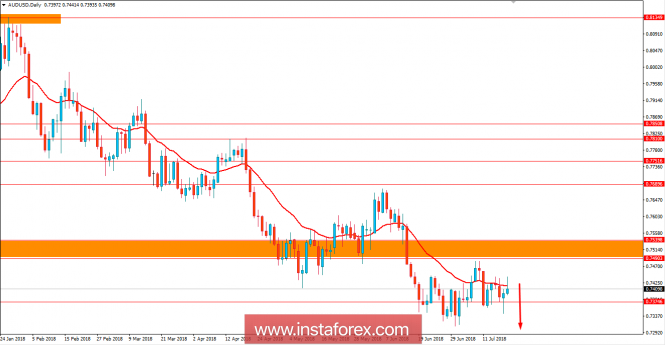

Now let us look at the technical view. The price has been in a downtrend for months now and after breaking below 0.75, certain volatility and correction is quite as expected. The price did push higher today but with current candle formation with certain bullish rejection and having a dynamic level of 20 EMA working as resistance, the price is expected to push much lower with a target towards 0.7350-0.7250 support area in the coming days. As the price remains below 0.75 with a daily close, the bearish bias is expected to continue further.

RESISTANCE: 0.7500

SUPPORT: 0.7350-0.7250

BIAS: BEARISH

MOMENTUM: VOLATILE and CORRECTIVE