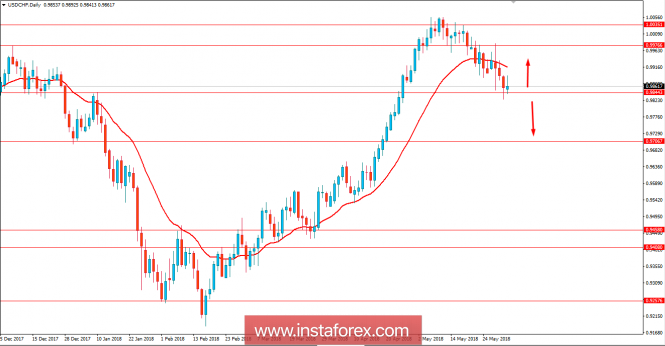

USD/CHF has been quite impressive inside the the bearish bias recently after being rejected off the 1.0035 area with a daily close. Ahead of the upcoming high impact US economic reports to be published today, the market is currently quite indecisive and volatile at the edge of 0.9850 area.

Today, US Average Hourly Earnings report is going to be published which is expected to increase to 0.2% from the previous value of 0.1%, Non-Farm Employment Change report is expected to increase to 189k from the previous figure of 164k and Unemployment Rate is expected to be unchanged at 3.9%. Though are a lot of speculations whether US economic reports wil be strong. If true, it may lead to further momentum in USD.

On the other hand, today Switzerland Manufacturing PMI report was published with a slight decrease to 62.4 from the previous figure of 63.6 which is expected to make certain weakness effect on the CHF gains against USD in the coming days.

As for the current scenario, high impact economic reports from the US today is expected to encourage USD gains further in the coming days. Though CHF has been gaining quite well against USD recently, upcoming positive economic reports may lead to continuation of the bullish trend in the pair in the future.

Now let us look at the technical view. The price is currently residing at the edge of 0.9850 support area from where certain bullish pressure is expected in this pair. Ahead of the upcoming high impact USD economic reports today, the market is expected to be volatile but as the price remains above 0.9850 with a daily close, certain bullish pressure is expected in this pair. On the other hand, a break below 0.9850 with a daily close, will lead to further bearish pressure in the pair with target towards 0.97.